Tax Form 8332 Printable

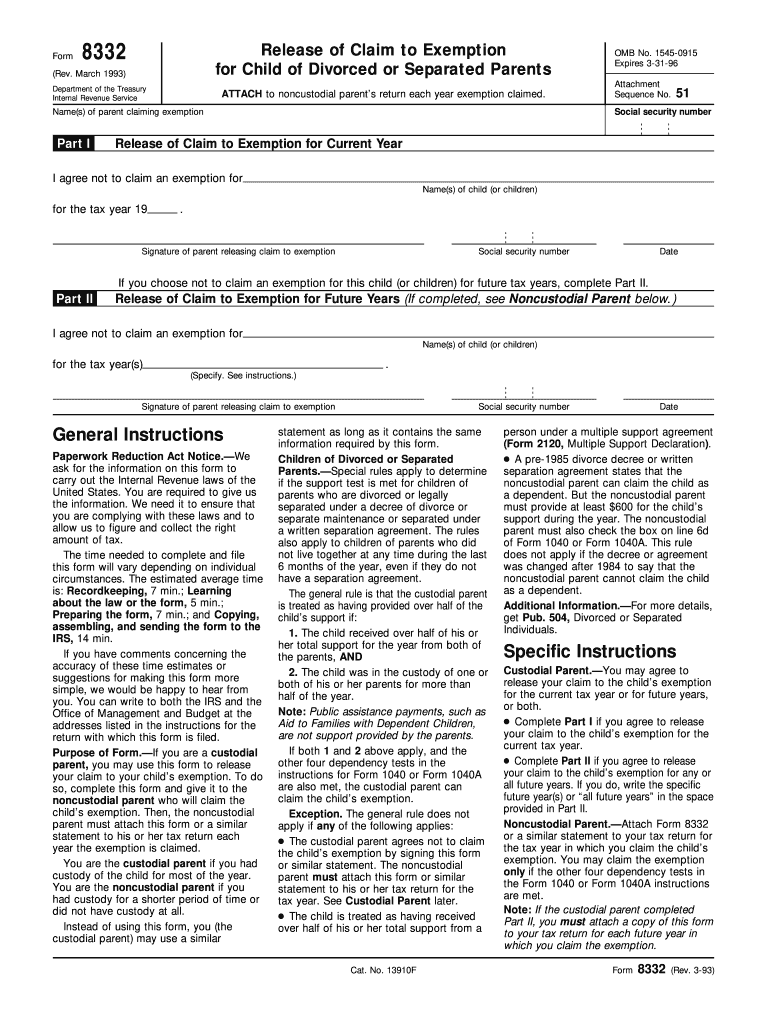

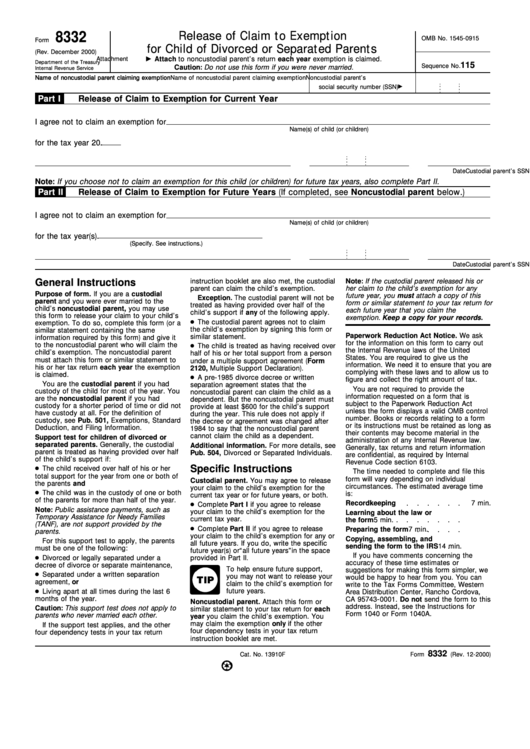

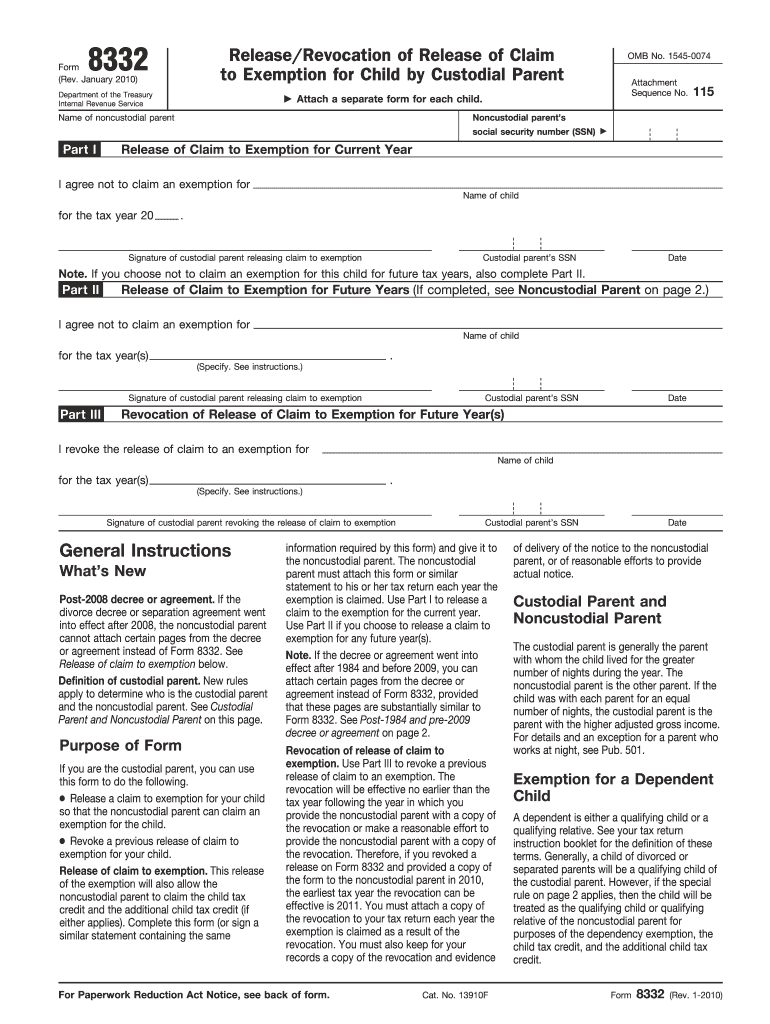

Tax Form 8332 Printable - Web select the button get form to open it and start modifying. Web prepare the form 8332 on the custodial parent's return. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of. Web to find and fill out form 8332: Web up to $40 cash back what is form 8332? The purpose of irs form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Web form 8332 is generally attached to the claimant's tax return. Open or continue your return in turbotax if you aren't already in it search for revocation of release of claim to exemption for child of. Web to find and fill out form 8332: Web form 8332 is generally attached to the claimant's tax return. Print, sign, and distribute to noncustodial parent. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of. Web up to $40 cash back what is form 8332? The purpose of irs form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. Print, sign, and distribute to noncustodial parent. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit. Open or continue your return in turbotax if. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit. Web form 8332 is generally attached to the claimant's tax return. Web to find and fill out form 8332: Web up to $40 cash back what is form 8332? The purpose of irs form 8332 is. Web to find and fill out form 8332: Fill all necessary lines in the document using our advantageous pdf editor. Web irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Web up to $40 cash back what is form. Web form 8332 is generally attached to the claimant's tax return. It also allows a noncustodial. Delete the data entered in screen 70, release of claim. The purpose of irs form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. Fill online, printable, fillable, blank form 8332 release of claim to child exemption. The child is treated as having received over half of his or her total support from a person under a multiple. Web form 8332 is generally attached to the claimant's tax return. Fill all necessary lines in the document using our advantageous pdf editor. Web select the button get form to open it and start modifying. Web to find and. Web fillable form 8332 release of claim to child exemption. Fill online, printable, fillable, blank form 8332 release of claim to child exemption form. Web the child’s exemption by signing this form or similar statement. The child is treated as having received over half of his or her total support from a person under a multiple. Web to find and. Web select the button get form to open it and start modifying. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Web irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in. The child is treated as having received over half of his or her total support from a person under a multiple. The purpose of irs form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. Web the child’s exemption by signing this form or similar statement. Web prepare the form 8332 on the. Web irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Web select the button get form to open it and start modifying. Web if you need to complete form 8332 release/revocation of release of claim to exemption for child. The child is treated as having received over half of his or her total support from a person under a multiple. Web fillable form 8332 release of claim to child exemption. Fill all necessary lines in the document using our advantageous pdf editor. Web select the button get form to open it and start modifying. Open or continue your return in turbotax if you aren't already in it search for revocation of release of claim to exemption for child of. Print, sign, and distribute to noncustodial parent. Web the child’s exemption by signing this form or similar statement. The purpose of irs form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. Web irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Switch the wizard tool on to complete. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of. Fill online, printable, fillable, blank form 8332 release of claim to child exemption form. Web prepare the form 8332 on the custodial parent's return. Web up to $40 cash back what is form 8332? Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. It also allows a noncustodial. Web to find and fill out form 8332: 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit. Delete the data entered in screen 70, release of claim. Web form 8332 is used to release your child's dependency exemption and child tax credit benefit to the noncustodial parent, or revoke this permission, for specific tax. Web form 8332 is generally attached to the claimant's tax return. Web to find and fill out form 8332: Web the child’s exemption by signing this form or similar statement. Web irs form 8332 get form now edit fill out sign export or print download your fillable irs form 8332 in pdf table of contents who should fill out the document? Delete the data entered in screen 70, release of claim. Web fillable form 8332 release of claim to child exemption. The purpose of irs form 8332 is to give a noncustodial parent the chance to claim an exemption for a child. The child is treated as having received over half of his or her total support from a person under a multiple. 2 relative of the noncustodial parent for purposes of the dependency exemption, the child tax credit, the additional child tax credit, and the credit. Fill all necessary lines in the document using our advantageous pdf editor. Web up to $40 cash back what is form 8332? Web if you need to complete form 8332 release/revocation of release of claim to exemption for child by custodial parent (usually only done by the custodial parent), you can do that. Fill online, printable, fillable, blank form 8332 release of claim to child exemption form. Web select the button get form to open it and start modifying. To complete form 8332 in turbo tax, type revocation of release of claim to exemption for child of.Tax Form 8332 Printable Portal Tutorials

Tax Form 8332 Printable Portal Tutorials

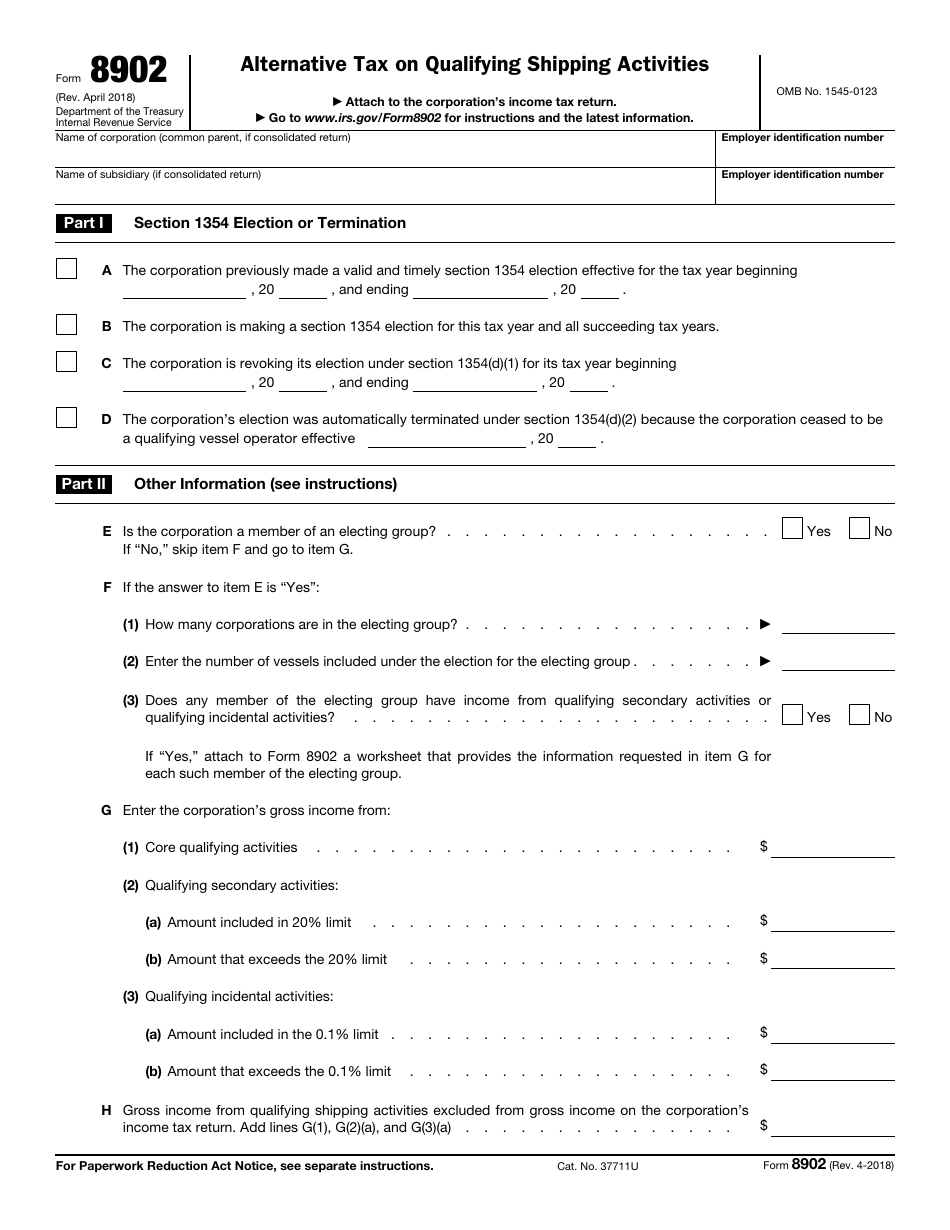

Irs Form 8332 Printable Portal Tutorials

IRS 8332 20182022 Fill and Sign Printable Template Online US Legal

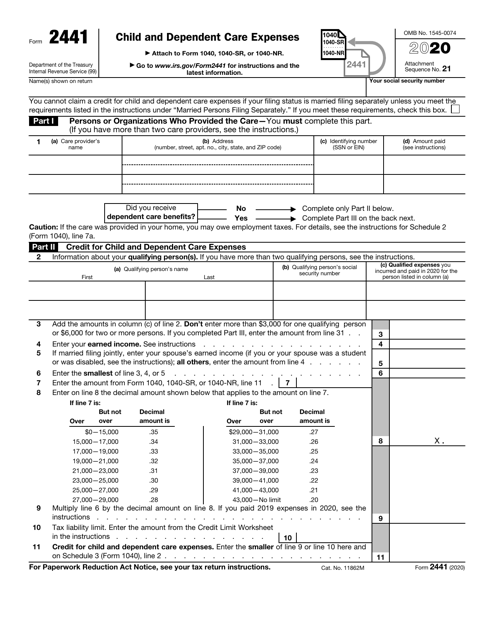

Printable Irs Forms 2021 8332 Calendar Printable Free

Tax Form 8332 Printable Master of Documents

Tax Form 8332 Printable 2021 Printable Form 2022

Fillable Form 8332 Release Of Claim To Exemption For Child Of

Tax Form 8332 Printable Master of Documents

Tax Form 8332 Printable Portal Tutorials

Web Prepare The Form 8332 On The Custodial Parent's Return.

Open Or Continue Your Return In Turbotax If You Aren't Already In It Search For Revocation Of Release Of Claim To Exemption For Child Of.

Switch The Wizard Tool On To Complete.

It Also Allows A Noncustodial.

Related Post: