Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

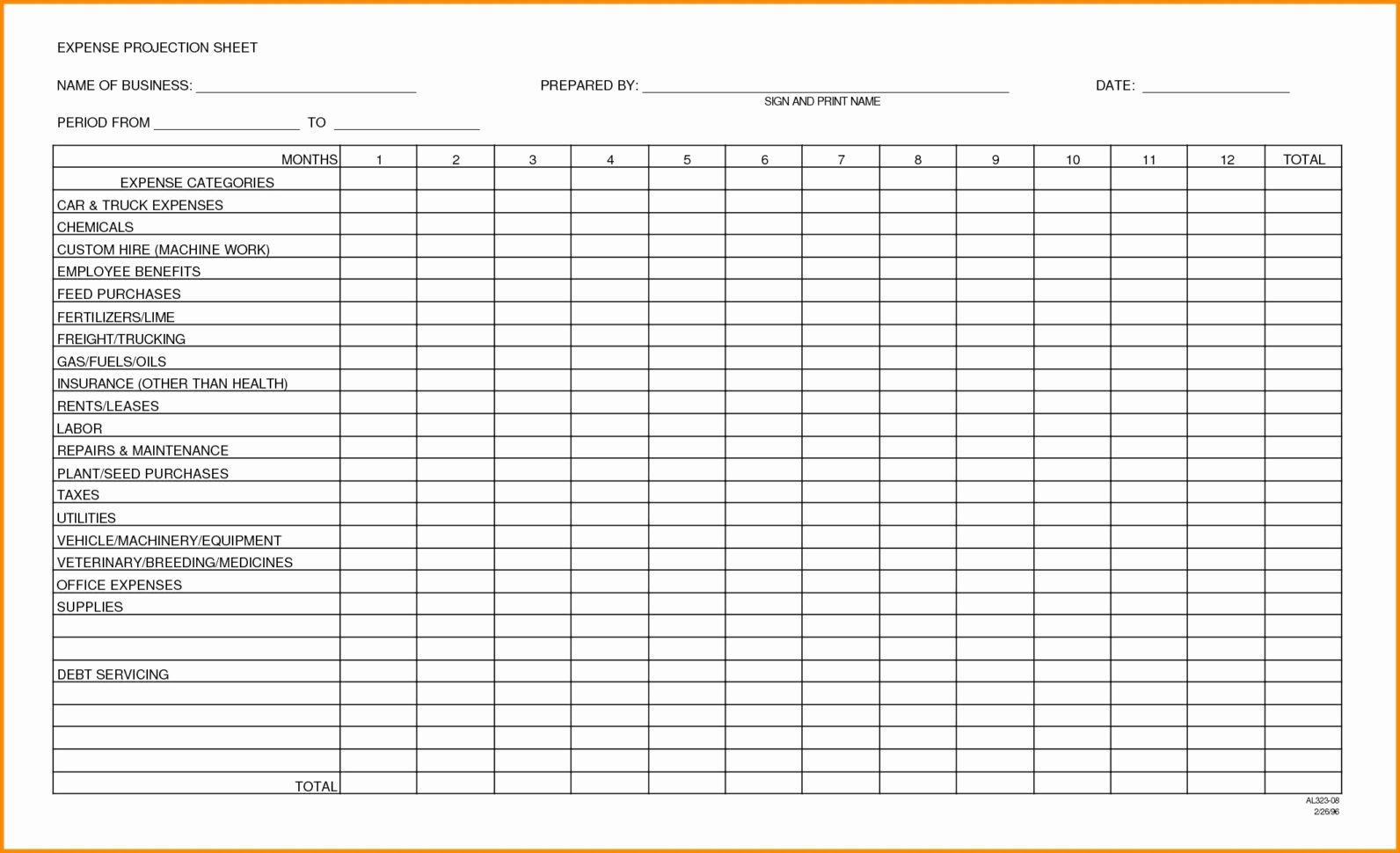

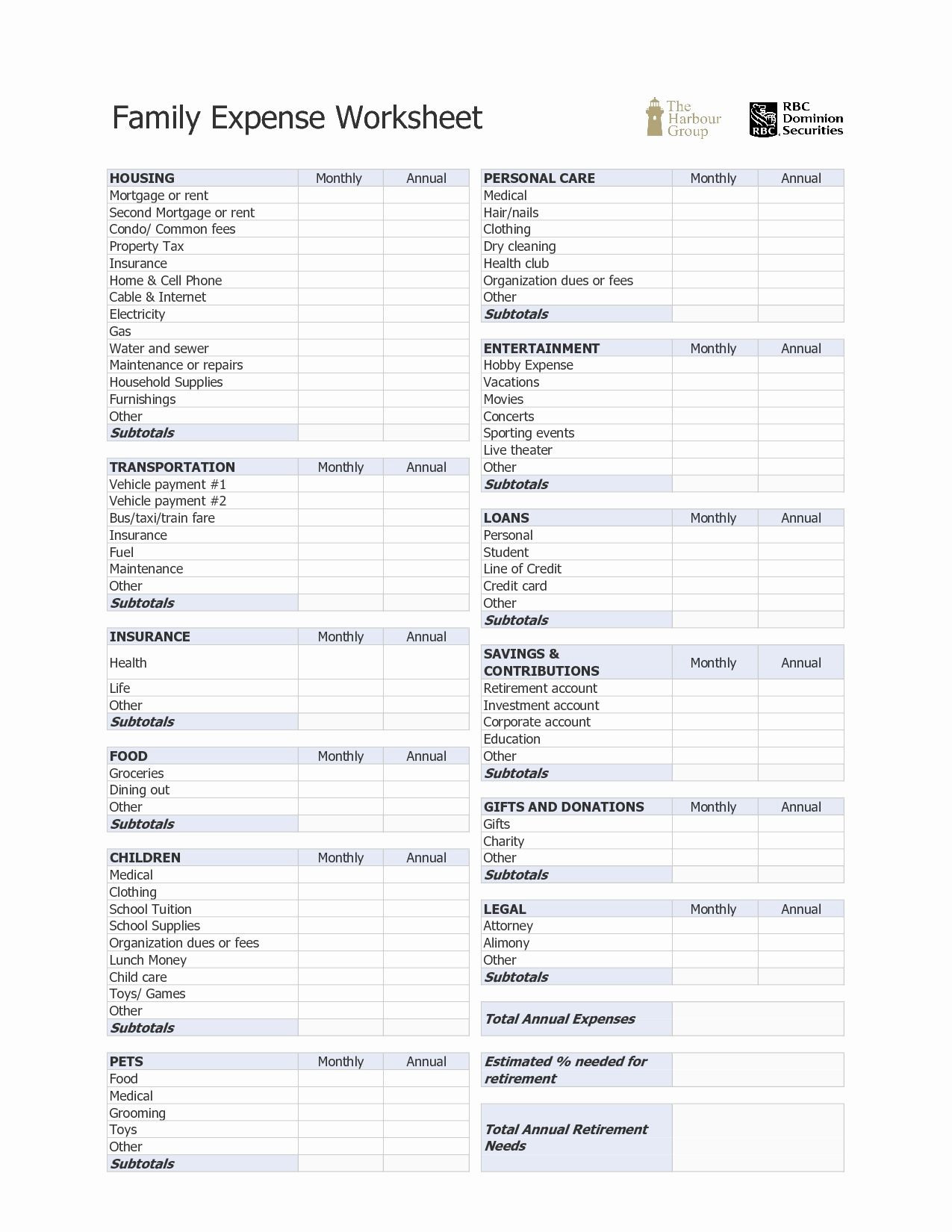

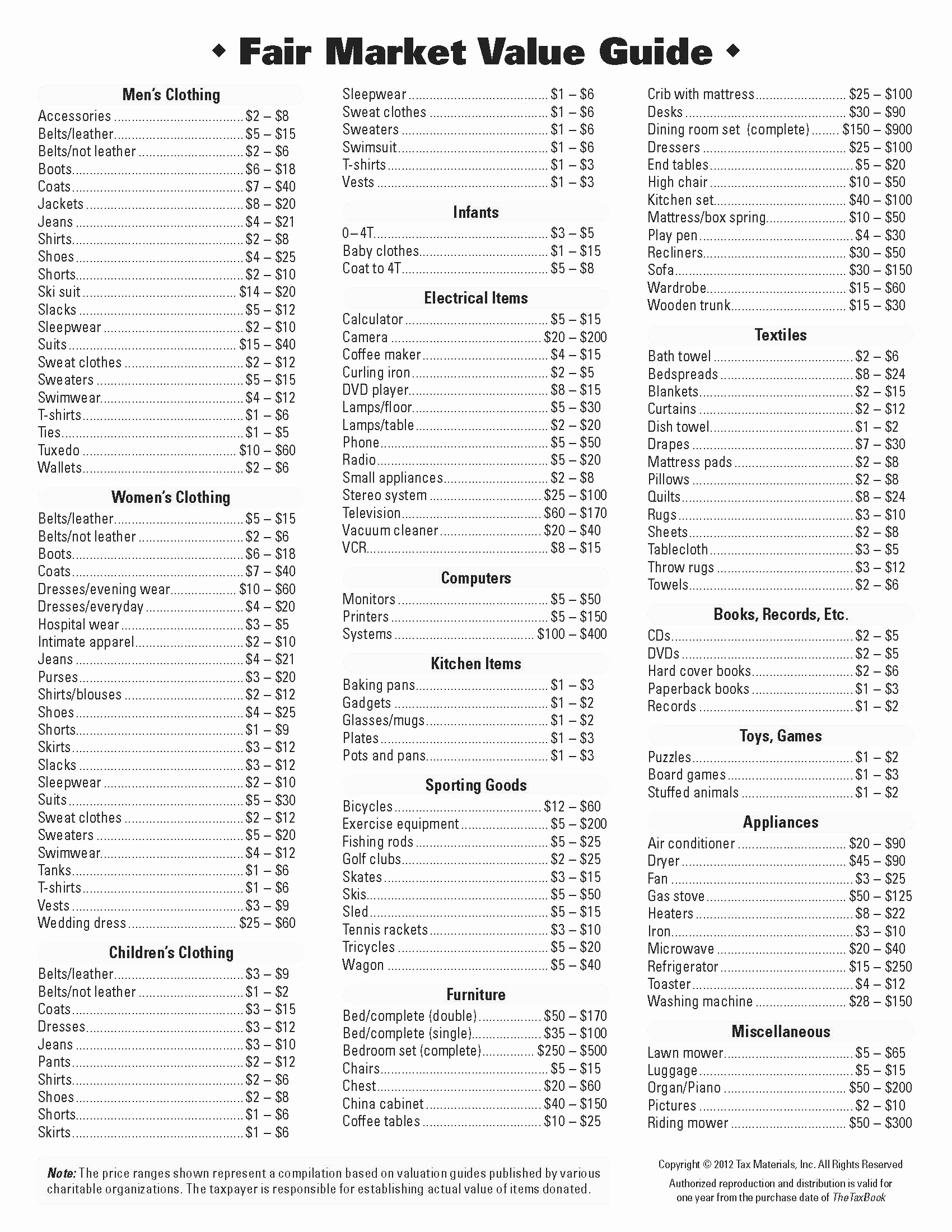

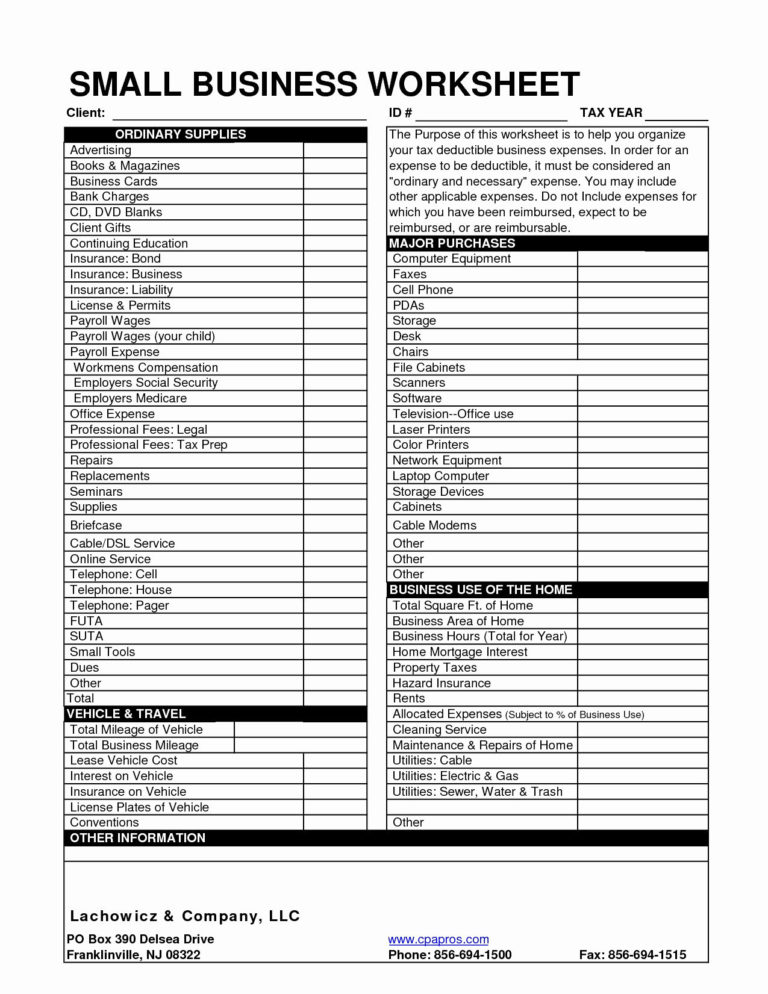

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and. Web most truck driver pay about $550 dollar for heavy highway use tax. With this form, you can track your mileage, fuel costs, and other expenses. Web forms that you should file as a truck driver depends on your type of employment: Since they aren't an employee they won't. Please visit the links below for more. For tax year 2021, participants with family coverage, the floor. How do i keep track of trucking expenses? Web printable truck driver expense owner operator tax deductions worksheet faq what is the expense for operating a truck? Web this truck driver expenses worksheet form can help make the process a little easier. Edit your tax deduction worksheet for truck. Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and. Web the fixed expenses in your spreadsheet can include vehicle payments, permit costs, insurance, licensing fees, physical damages, and other miscellaneous. Web most truck driver pay about $550 dollar for heavy highway use tax. Web truck driver expenses worksheet. Web here is a list of some of the items you might be able to deduct: Web the fixed expenses in your spreadsheet can include vehicle payments, permit costs, insurance, licensing fees, physical damages, and other miscellaneous. For tax year 2021, participants with family coverage, the floor. Web printable truck driver expense owner operator tax deductions worksheet faq what is. Web a driver’s daily logbook is where each driver keeps the record of their driving hours. Web truck driver expenses worksheet. Web forms that you should file as a truck driver depends on your type of employment: For tax year 2021, participants with family coverage, the floor. Since they aren't an employee they won't. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. You can also download it, export it or print it out. Web a driver’s daily logbook is where each driver keeps the record of their driving hours. Since they aren't an employee they won't. Edit your tax deduction worksheet for truck. Web this truck driver expenses worksheet form can help make the process a little easier. Web the fixed expenses in your spreadsheet can include vehicle payments, permit costs, insurance, licensing fees, physical damages, and other miscellaneous. Web forms that you should file as a truck driver depends on your type of employment: Signnow combines ease of use,. Edit your tax. Web a driver’s daily logbook is where each driver keeps the record of their driving hours. In fact, the federal motor carrier safety. Web these printable truck driver expense owner operator tax deductions worksheets can be personalized to fit the demands of the specific child or classroom,. This is 100% tax deductible and truck driver can deduct the cost of. How do i keep track of trucking expenses? Web forms that you should file as a truck driver depends on your type of employment: This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Truck driver tax deductions reduce your tax burden in two ways: Web this truck driver expenses worksheet form can. This is not only a safety measure but a federal law. Web these printable truck driver expense owner operator tax deductions worksheets can be personalized to fit the demands of the specific child or classroom,. With this form, you can track your mileage, fuel costs, and other expenses. Web send 2020 truck driver tax deductions worksheet via email, link, or. Web printable truck driver expense owner operator tax deductions worksheet faq what is the expense for operating a truck? In fact, the federal motor carrier safety. First, the money you spend on deductible expenses is. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Edit your tax deduction worksheet for truck. Web most truck driver pay about $550 dollar for heavy highway use tax. You can also download it, export it or print it out. How do i keep track of trucking expenses? First, the money you spend on deductible expenses is. Web here is a list of some of the items you might be able to deduct: This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. Web truck driver expenses worksheet. Signnow combines ease of use,. Web these printable truck driver expense owner operator tax deductions worksheets can be personalized to fit the demands of the specific child or classroom,. Vehicle expenses, such as tolls, parking, maintenance, fuel, registration fees, tires and. This is not only a safety measure but a federal law. With this form, you can track your mileage, fuel costs, and other expenses. Web forms that you should file as a truck driver depends on your type of employment: Truck driver tax deductions reduce your tax burden in two ways: Web this truck driver expenses worksheet form can help make the process a little easier. Web send 2020 truck driver tax deductions worksheet via email, link, or fax. You can also download it, export it or print it out. For tax year 2021, participants with family coverage, the floor. How do i keep track of trucking expenses? First, the money you spend on deductible expenses is. Since they aren't an employee they won't. Web most truck driver pay about $550 dollar for heavy highway use tax. Web printable truck driver expense owner operator tax deductions worksheet faq what is the expense for operating a truck? Edit your tax deduction worksheet for truck. In fact, the federal motor carrier safety. Web send 2020 truck driver tax deductions worksheet via email, link, or fax. Web most truck driver pay about $550 dollar for heavy highway use tax. Signnow combines ease of use,. For tax year 2021, participants with family coverage, the floor. With this form, you can track your mileage, fuel costs, and other expenses. Web truck driver expenses worksheet. First, the money you spend on deductible expenses is. This is 100% tax deductible and truck driver can deduct the cost of highway use tax that. How do i keep track of trucking expenses? Since they aren't an employee they won't. Web these printable truck driver expense owner operator tax deductions worksheets can be personalized to fit the demands of the specific child or classroom,. In fact, the federal motor carrier safety. You can also download it, export it or print it out. Please visit the links below for more. Web the fixed expenses in your spreadsheet can include vehicle payments, permit costs, insurance, licensing fees, physical damages, and other miscellaneous. This is not only a safety measure but a federal law.Free Owner Operator Expense Spreadsheet Google Spreadshee free owner

Truck Driver Tax Deductions Worksheet —

31 Truck Driver Expenses Worksheet support worksheet

2020 Truck Driver Tax Deductions Worksheet Fill Online, Printable

Tax worksheet realtors Fill out & sign online DocHub

Trucker Expense Spreadsheet Beautiful Tax Deduction Worksheet For

10 Business Tax Deductions Worksheet /

Truck Driver Tax Deductions Best Truck In The World —

Truck Driver T Trucker Tax Deduction Worksheet Perfect —

Free Owner Operator Expense Spreadsheet in Truck Driver Expenset

Web Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet Faq What Is The Expense For Operating A Truck?

Web A Driver’s Daily Logbook Is Where Each Driver Keeps The Record Of Their Driving Hours.

Vehicle Expenses, Such As Tolls, Parking, Maintenance, Fuel, Registration Fees, Tires And.

Web Here Is A List Of Some Of The Items You Might Be Able To Deduct:

Related Post: