Printable Irs Form 9465

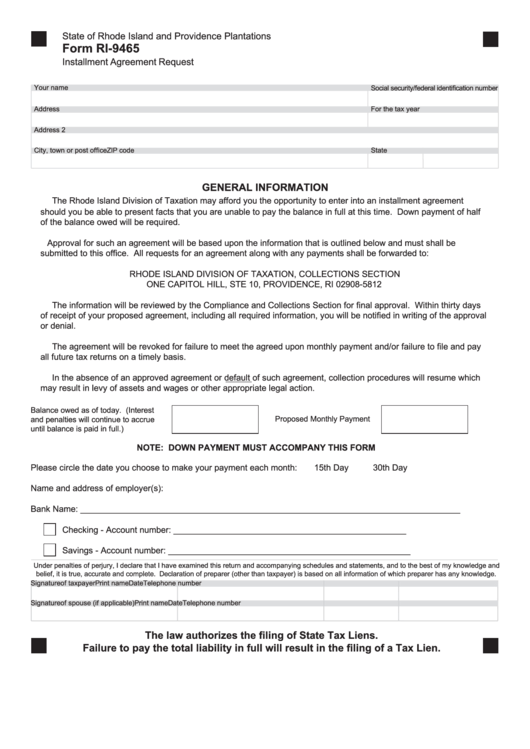

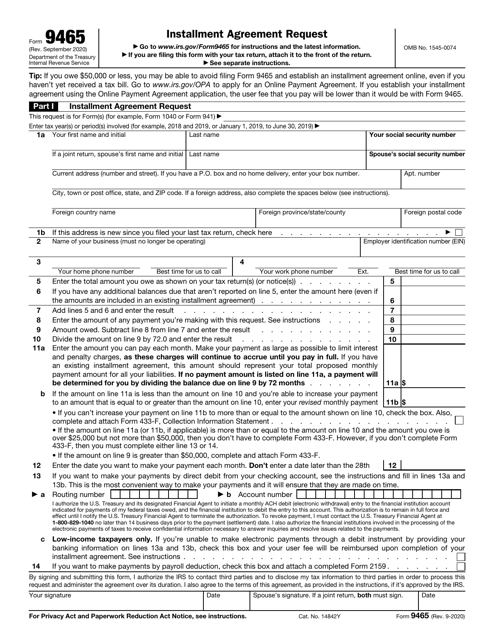

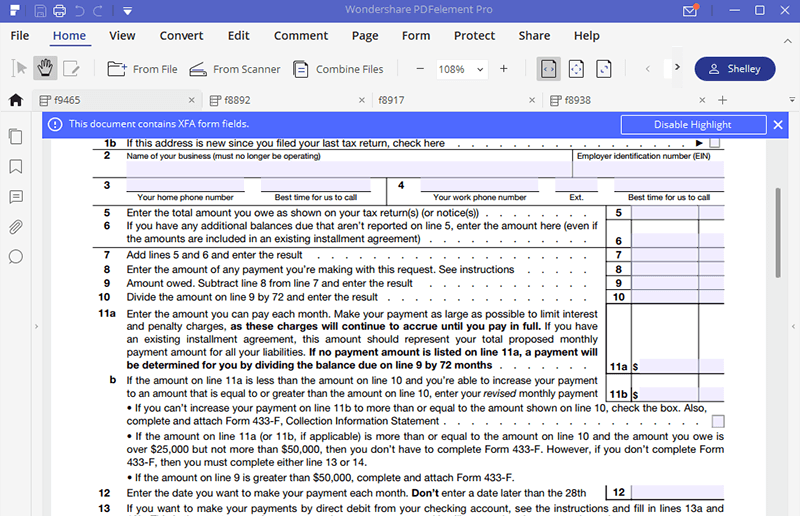

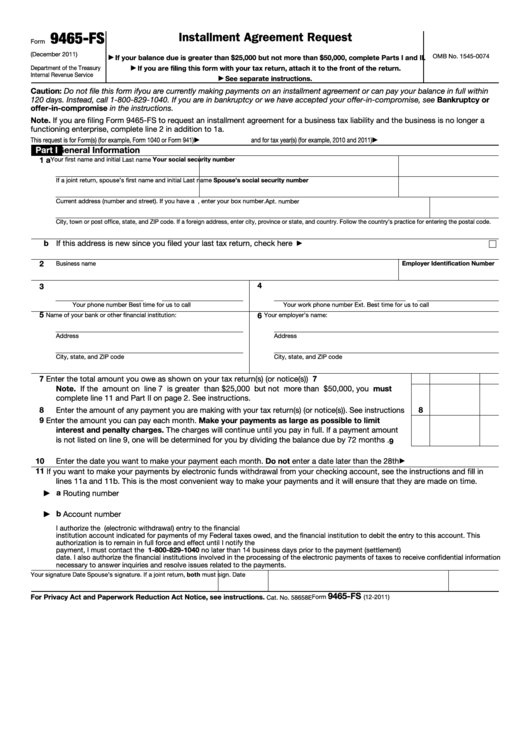

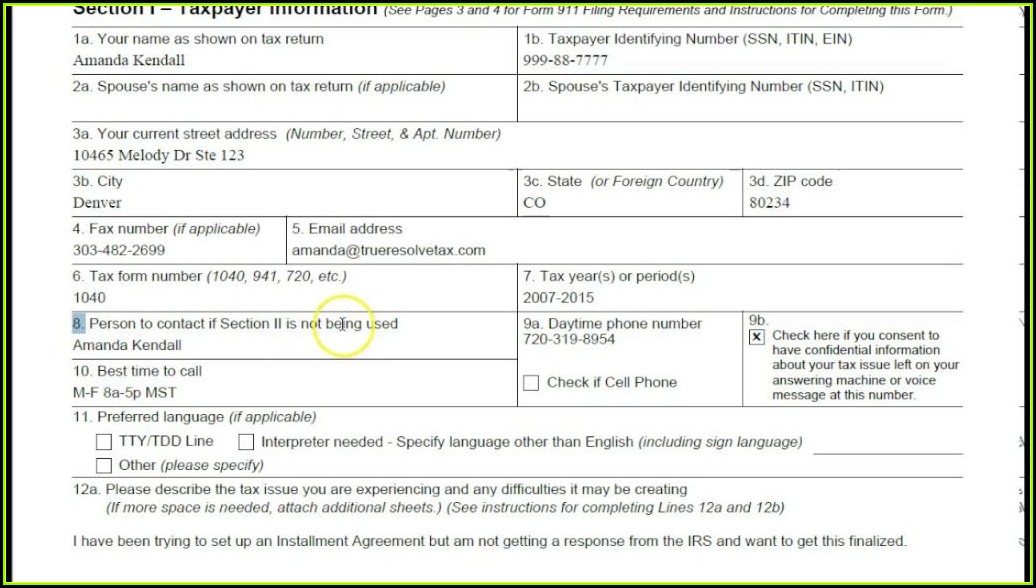

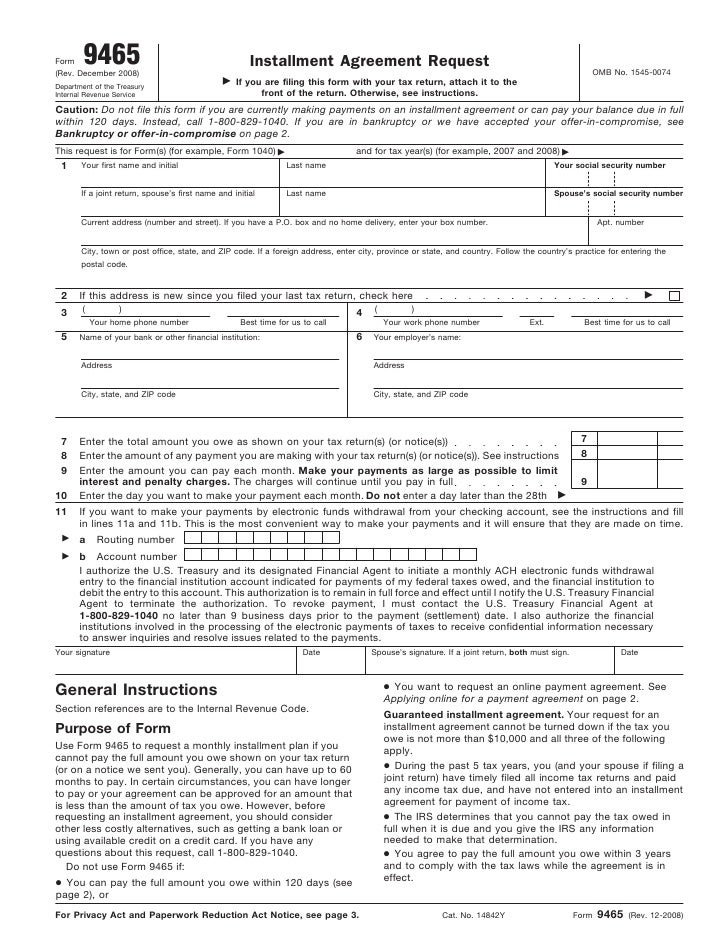

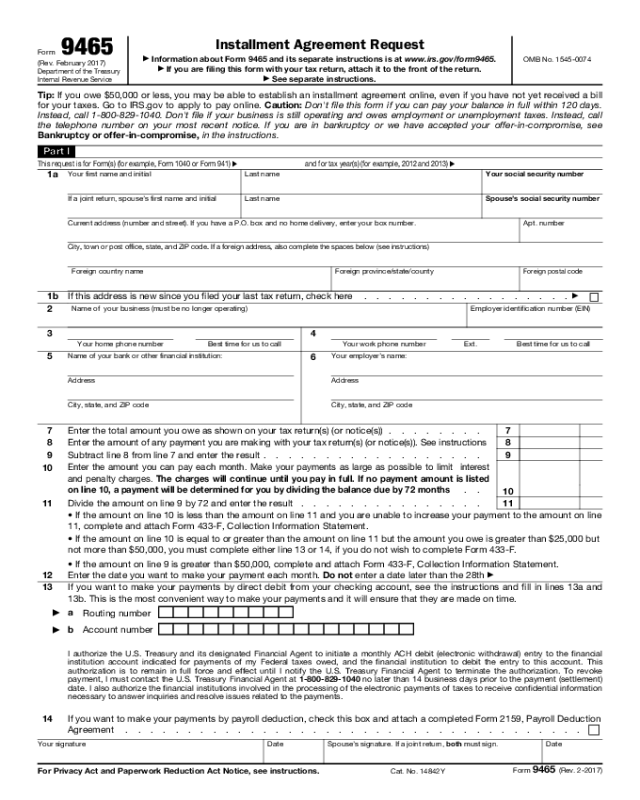

Printable Irs Form 9465 - Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). All forms are printable and downloadable. Web the irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web form 9465 is primarily for individuals. Web we last updated the installment agreement request in january 2023, so this is the latest version of form 9465, fully updated for tax year 2022. December 2011) department of the treasury internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). The following taxpayers can use form 9465 to request a payment plan: The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Businesses can only use this form if they are out of business. Importance of irs form payment plan 9465. You can file form 9465 by itself, even if you've already filed your individual tax return. Enter your official contact and identification details. Installment agreement request (irs) on average this form takes 15 minutes to complete. Web taxpayers who can't pay their tax obligation can file form 9465 to set up a monthly. Web part i this request is for form(s) (for example, form 1040 or form 941) enter tax year(s) or period(s) involved (for example, 2016 and 2017, or january 1, 2017 to june 30, 2017) city, town or post office, state, and zip code. This form is for income earned in tax year 2022, with tax returns due in april 2023.. You can file form 9465 by itself, even if. Form 9465 is available in all versions of taxact ®. You can file form 9465 by itself, even if you've already filed your individual tax return. The following taxpayers can use form 9465 to request a payment plan: Web we last updated the installment agreement request in january 2023, so this. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). Businesses can only use this form if they are out of business. Web use fill to complete blank online irs pdf forms for free. Internal revenue service see separate instructions.. Web part i this request is for form(s) (for example, form 1040 or form 941) enter tax year(s) or period(s) involved (for example, 2016 and 2017, or january 1, 2017 to june 30, 2017) city, town or post office, state, and zip code. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't. This form allows you to pay off your tax. Installment agreement request (irs) on average this form takes 15 minutes to complete. Most installment agreements meet our streamlined installment agreement criteria. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. It is a good idea to at least pay a portion of our tax debt before asking for the payment plan. Web irs form 9465 get form now edit fill out sign export or print download your fillable irs form 9465 in pdf table. Apply a check mark to point the choice where necessary. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. Form 9465 is available in all versions of taxact ®. The maximum term for a streamlined agreement is 72 months. The following taxpayers can use form 9465 to request a payment plan: The maximum term for a streamlined agreement is 72 months. Once completed you can sign your fillable form or send for signing. Individuals who owe income tax from form 1040. Web we last updated federal form 9465 in january 2023 from the federal internal revenue service. With this form, you can arrange to pay what you owe within 60 months. It is a good idea to at least pay a portion of our tax debt before asking for the payment plan. You can file form 9465 by itself, even if. December 2011) department of the treasury internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return.. In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. Web form (december 2011) if your balance due is greater than $25,000 but not more than $50,000, complete parts i and ii.omb no. Form 9465 is available in all versions of taxact ®. Sign online button or tick the preview image of the form. Apply a check mark to point the choice where necessary. Individuals who owe income tax from form 1040. Enter your official contact and identification details. Web part i this request is for form(s) (for example, form 1040 or form 941) enter tax year(s) or period(s) involved (for example, 2016 and 2017, or january 1, 2017 to june 30, 2017) city, town or post office, state, and zip code. Web use irs form 9465 installment agreement request to request a monthly installment plan if you can't pay your full tax due amount. The irs encourages you to pay a portion of the amount you owe and then request an installment for the remaining balance. Web irs form payment plan 9465 is a document you can file to request said payment plan. Any taxpayer owing no more than $10,000 will have. This form is for income earned in tax year 2022, with tax returns due in april 2023. The advanced tools of the editor will direct you through the editable pdf template. It is a good idea to at least pay a portion of our tax debt before asking for the payment plan. Web irs form 9465 get form now edit fill out sign export or print download your fillable irs form 9465 in pdf table of contents purposes and main requirements who can apply contract guarantee installment agreement definitions and rules where to apply how to fill out the form purposes and main requirements If a foreign address, also complete the spaces below (see instructions). You can file form 9465 by itself, even if you've already filed your individual tax return. Importance of irs form payment plan 9465. Installment agreement request (irs) on average this form takes 15 minutes to complete. The maximum term for a streamlined agreement is 72 months. Apply a check mark to point the choice where necessary. Web use form 9465 to request a monthly installment agreement (payment plan) if you can’t pay the full amount you owe shown on your tax return (or on a notice we sent you). We will update this page with a new version of the form for 2024 as soon as it is made available by the federal government. You can file form 9465 by itself, even if. Web form 9465 is primarily for individuals. The advanced tools of the editor will direct you through the editable pdf template. Use form 9465 to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). It is a good idea to at least pay a portion of our tax debt before asking for the payment plan. In most cases, it is a good idea to pay a portion of your tax debt before asking for payment assistance from the irs for the leftover balance. Web irs form 9465 get form now edit fill out sign export or print download your fillable irs form 9465 in pdf table of contents purposes and main requirements who can apply contract guarantee installment agreement definitions and rules where to apply how to fill out the form purposes and main requirements Enter your official contact and identification details. You can file form 9465 by itself, even if you've already filed your individual tax return. This form is for income earned in tax year 2022, with tax returns due in april 2023. Any taxpayer owing no more than $10,000 will have. Do not file this form if you are currently making payments on an installment agreement or can pay your.Form Ri9465 Installment Agreement Request printable pdf download

IRS Form 9465 Download Fillable PDF or Fill Online Installment

IRS Form 9465 Instructions for How to Fill it Correctly File

Irs Form 9465 Fillable and Editable PDF Template

Fillable Form 9465Fs Installment Agreement Request printable pdf

Irs form 9465 Fillable form 9465 Installment Agreement Ideal New Stock

Irs Form 9465 Fs Form Resume Examples AjYdJvE2l0

Form 9465Installment Agreement Request

Form 9465 Edit, Fill, Sign Online Handypdf

How Do I Set Up an Installment Agreement; IRS Just Sent Me Form 9465

Form 9465 Is Available In All Versions Of Taxact ®.

December 2011) Department Of The Treasury Internal Revenue Service Installment Agreement Request If You Are Filing This Form With Your Tax Return, Attach It To The Front Of The Return.

Web Use Irs Form 9465 Installment Agreement Request To Request A Monthly Installment Plan If You Can't Pay Your Full Tax Due Amount.

Individuals Who Owe Income Tax From Form 1040.

Related Post: