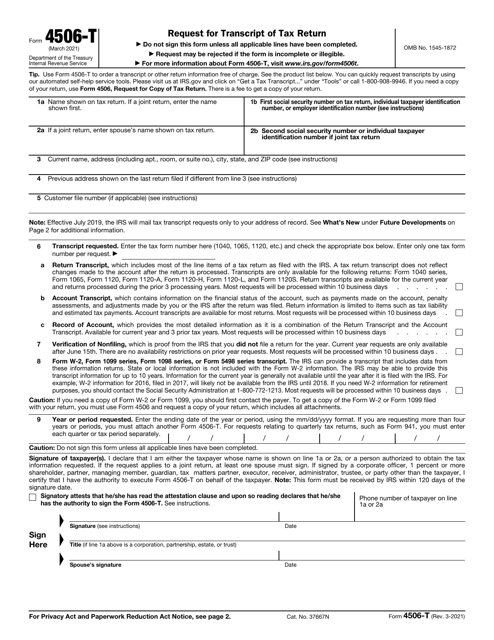

Printable 4506 T Form

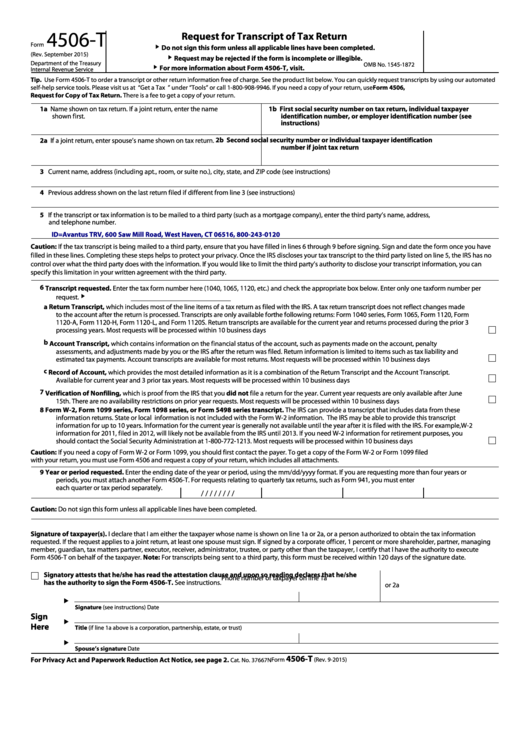

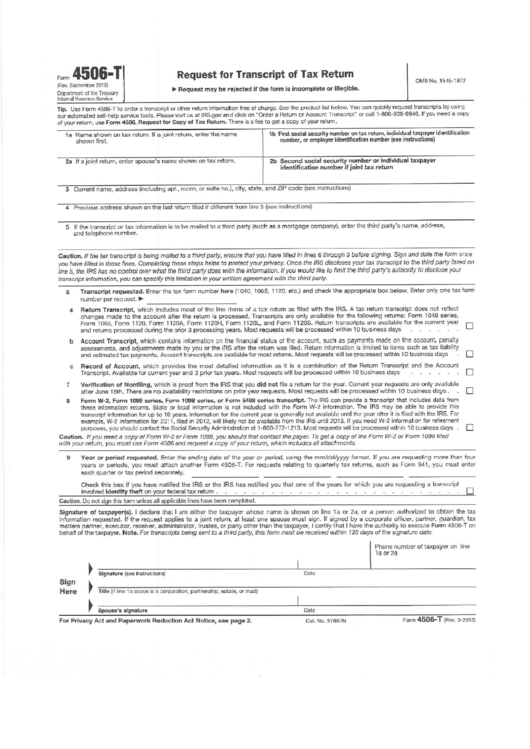

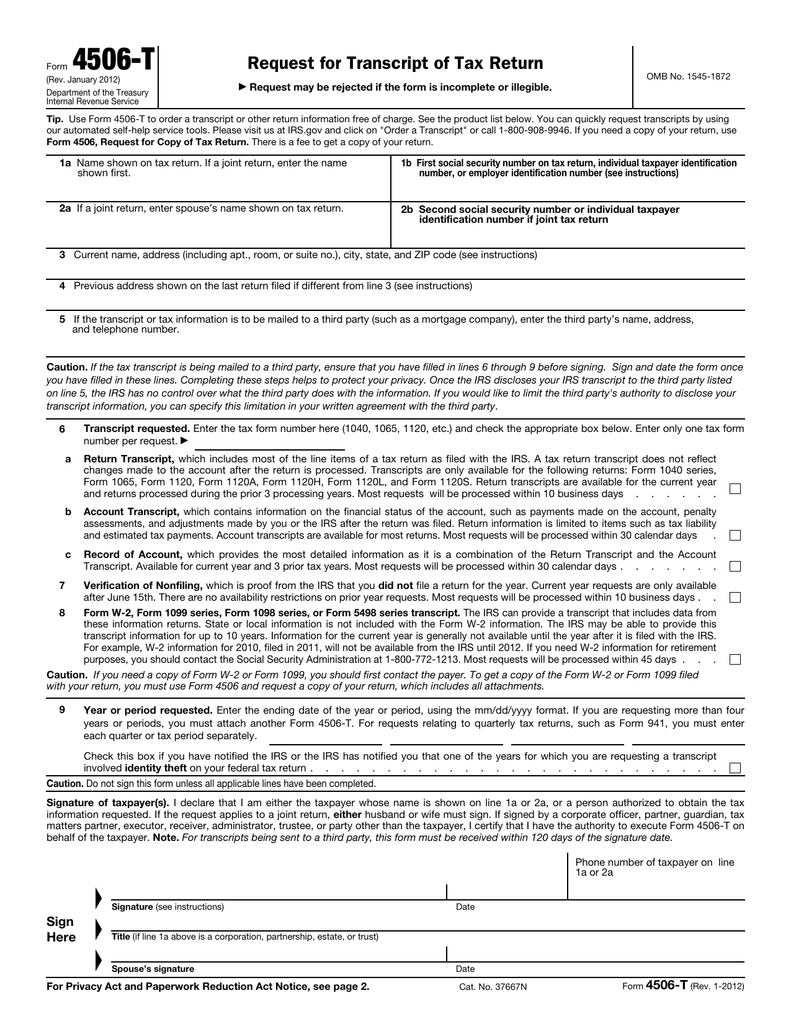

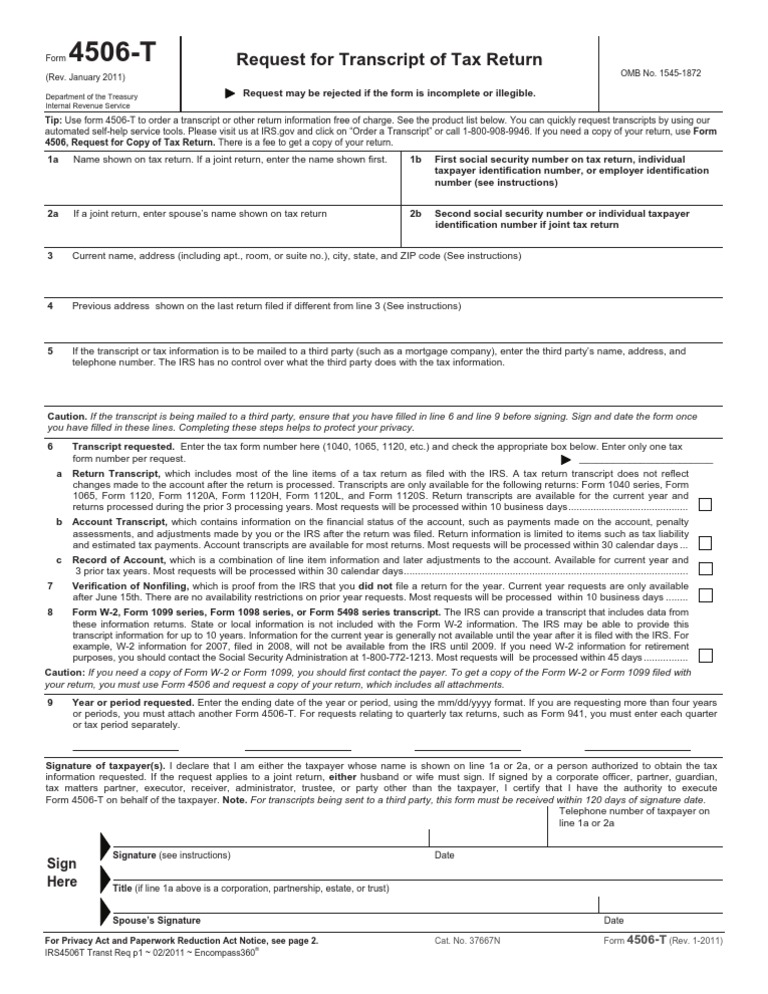

Printable 4506 T Form - The transcript format better protects taxpayer data by partially masking personally identifiable information. Taxpayers can request a transcript of their entire tax. Request may be rejected if the form is incomplete or illegible. See the product list below. Do not sign this form unless all applicable lines have been completed. Request for transcript of tax return. People can also use this form to request that. About this document and download. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. This form is used when people want to receive a tax return transcript, tax return, or other tax records. Web do not sign this form unless all applicable lines have been completed. People can also use this form to request that. The transcript format better protects taxpayer data by partially masking personally identifiable information. See the product list below. Request may be rejected if the form is incomplete or illegible. You can expect to receive a return transcript for the tax year 2018 at the address provided in the telephone request within 5 to 10 days from the time of the request. Do not sign this form unless all applicable lines have been completed. See the product list below.. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. People can also use this form to request that. Request may be rejected if the form is incomplete or illegible. Web do not sign this form unless all applicable lines have been completed. Disaster request for transcript of. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. See the product list below. People can also use this form to request that. Do not sign this form unless all applicable lines have been completed. See the product list below. About this document and download. See the product list below. People can also use this form to request that. Taxpayers can request a transcript of their entire tax. Request may be rejected if the form is incomplete or illegible. Web what is a 4506 t? Covid eidl disaster request for transcript of tax return. Web do not sign this form unless all applicable lines have been completed. People can also use this form to request that. Do not sign this form unless all applicable lines have been completed. You can expect to receive a return transcript for the tax year 2018 at the address provided in the telephone request within 5 to 10 days from the time of the request. The transcript format better protects taxpayer data by partially masking personally identifiable information. See the product list below. Web what is a 4506 t? Request for transcript of. Disaster request for transcript of tax return. Request for transcript of tax return. See the product list below. The transcript format better protects taxpayer data by partially masking personally identifiable information. This form is used when people want to receive a tax return transcript, tax return, or other tax records. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. Web do not sign this form unless all applicable lines have been completed. Do not sign this form unless all applicable lines have been completed. Request for transcript of tax return. Request may be rejected if the form is. Request may be rejected if the form is incomplete or illegible. Taxpayers can request a transcript of their entire tax. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. Web do not sign this form unless all applicable lines have been completed. Do not sign this form unless. About this document and download. The transcript format better protects taxpayer data by partially masking personally identifiable information. Request for transcript of tax return. Web what is a 4506 t? See the product list below. Request may be rejected if the form is incomplete or illegible. Web do not sign this form unless all applicable lines have been completed. See the product list below. Request may be rejected if the form is incomplete or illegible. People can also use this form to request that. Taxpayers can request a transcript of their entire tax. Covid eidl disaster request for transcript of tax return. Request may be rejected if the form is incomplete or illegible. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. Do not sign this form unless all applicable lines have been completed. This form is used when people want to receive a tax return transcript, tax return, or other tax records. See the product list below. Disaster request for transcript of tax return. Do not sign this form unless all applicable lines have been completed. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. Do not sign this form unless all applicable lines have been completed. See the product list below. Covid eidl disaster request for transcript of tax return. Taxpayers can request a transcript of their entire tax. This form gives permission for the irs to provide sba your tax return information when applying for covid eidl disaster loan assistance. This form is used when people want to receive a tax return transcript, tax return, or other tax records. Disaster request for transcript of tax return. You can expect to receive a return transcript for the tax year 2018 at the address provided in the telephone request within 5 to 10 days from the time of the request. See the product list below. The blank also requires the taxpayer to give the information about the type of tax return transcript that they are requesting. The transcript format better protects taxpayer data by partially masking personally identifiable information. Request for transcript of tax return. Request may be rejected if the form is incomplete or illegible. Web do not sign this form unless all applicable lines have been completed. People can also use this form to request that. Request may be rejected if the form is incomplete or illegible.Form 4506T Request for Transcript of Tax Return (2015) Free Download

Download IRS Form 4506t for Free FormTemplate

Fillable Form 4506T Request For Transcript Of Tax Return printable

Form 4506T Form Request For Transcript Of Tax Return printable pdf

4506T Request for Transcript of Tax Return

4506 t Fill Online, Printable, Fillable Blank

2011 4506 T Fill Out and Sign Printable PDF Template signNow

4506T Form Tax Return (United States) Irs Tax Forms

IRS Form 4506T Download Fillable PDF or Fill Online Request for

4506t fillable 2017 Fill out & sign online DocHub

Web What Is A 4506 T?

Do Not Sign This Form Unless All Applicable Lines Have Been Completed.

Request May Be Rejected If The Form Is Incomplete Or Illegible.

About This Document And Download.

Related Post: