Montana W 4 Printable

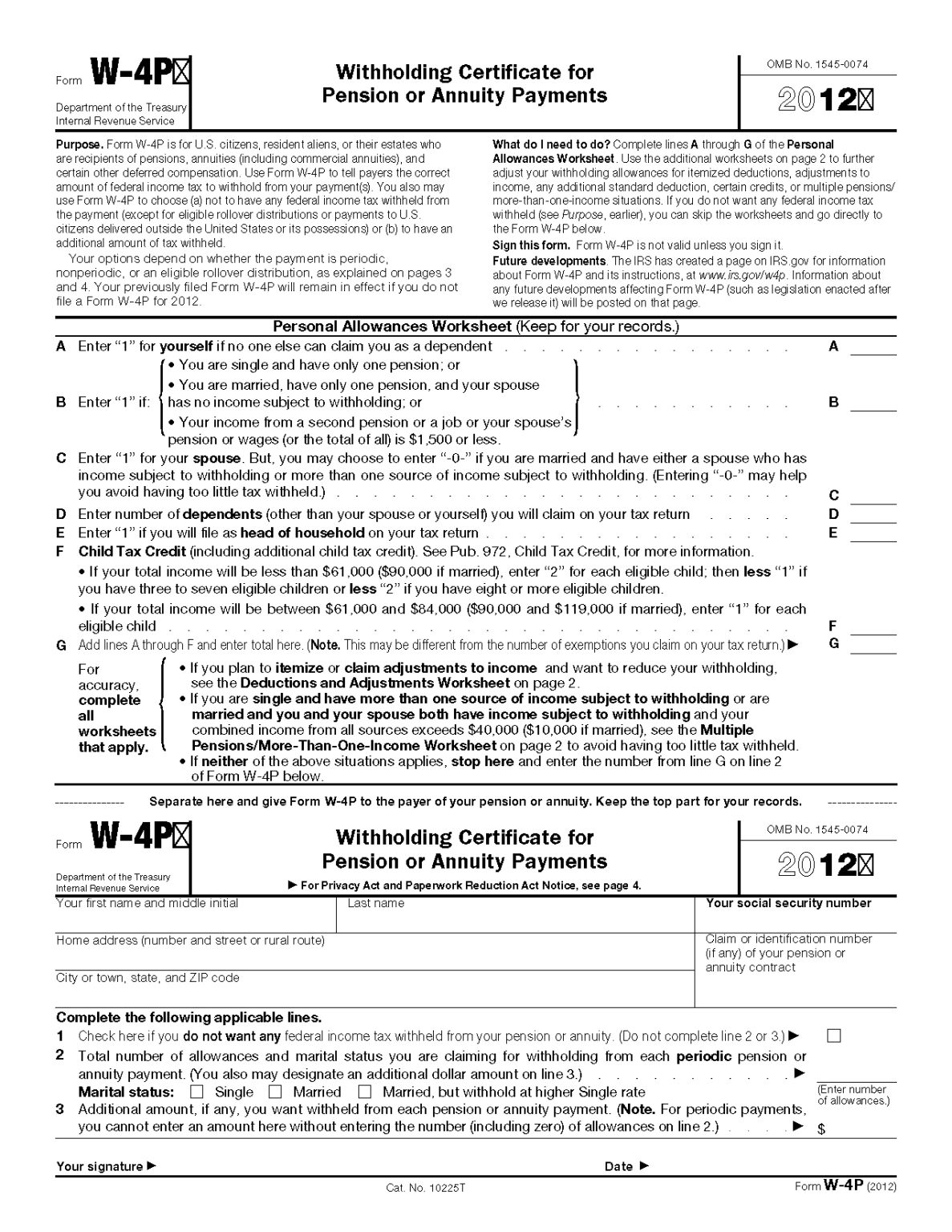

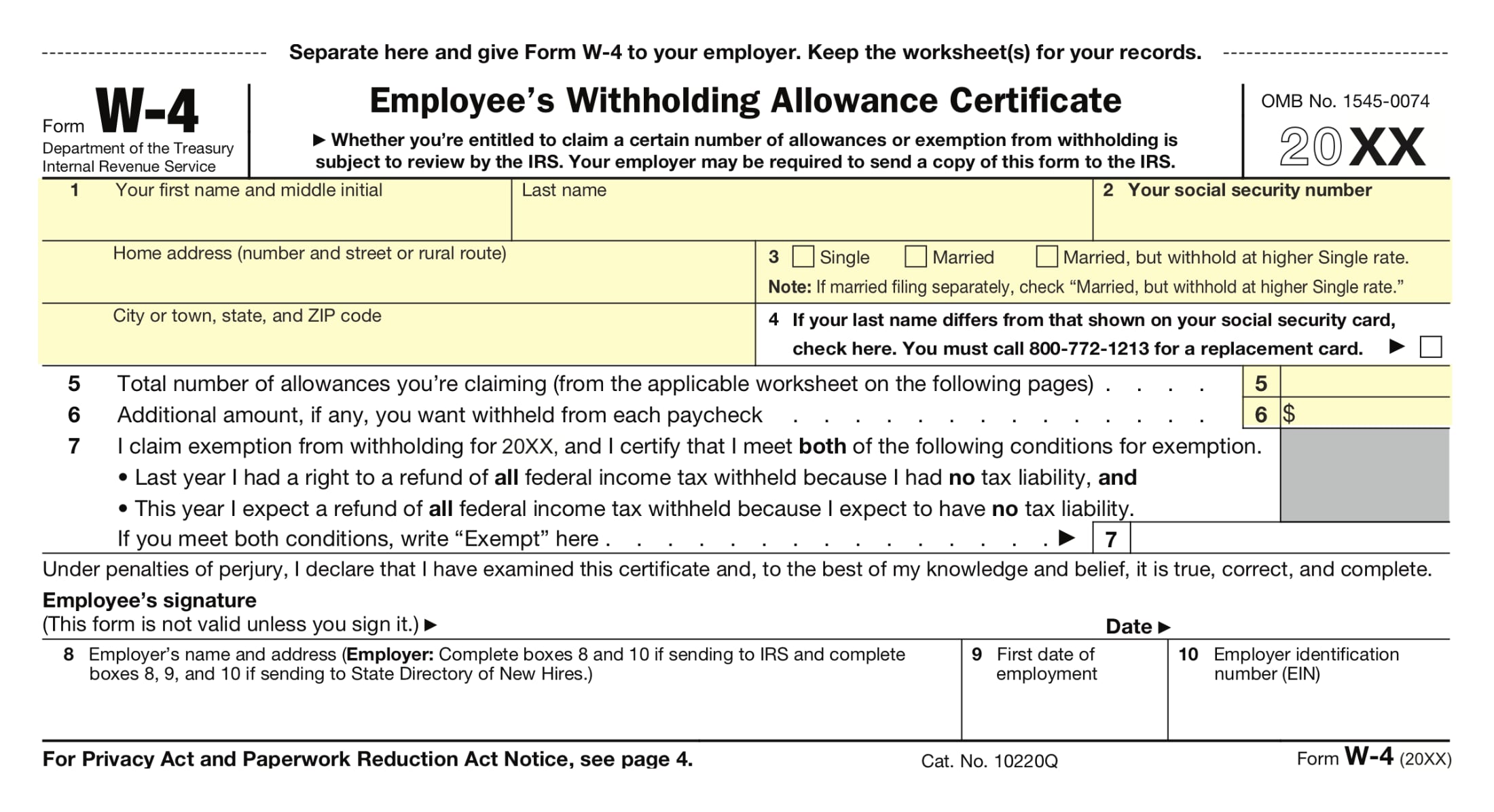

Montana W 4 Printable - Carol does not have a job, but she also receives another pension for $25,000 a year (which If too much is withheld, you will generally be due a refund. The advanced tools of the editor will direct you through the editable pdf template. Web printer friendly version 42.17.111 montana income tax withholding; 2023 city of billings employees benefit plan document and summary of benefits & coverages. Details on how to only prepare and print a montana 2022 tax return. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Are a newly hired employee, or claim to be exempt from montana income tax withholding. Montana state income tax forms for tax year 2022 (jan. Provide all the numbers of the id. Healthy is wellness incentive flier. Carol does not have a job, but she also receives another pension for $25,000 a year (which Web printer friendly version 42.17.111 montana income tax withholding; Provide all the numbers of the id. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. An exemption from withholding is available only if the entire statement you checked in section 2 is true. Web printable forms for claimants. • they are a newly hired employee, or • they are claiming to be exempt from montana income tax withholding. Ui claimants are required to report hours worked and earnings received during the week when. Provide all. You must fill out new forms if your information changes (marriage, withholding amount, etc). An exemption from withholding is available only if the entire statement you checked in section 2 is true. Your withholding is subject to review by the irs. If too much is withheld, you will generally be due a refund. Employees who already claimed allowances in previous. If too much is withheld, you will generally be due a refund. You must fill out new forms if your information changes (marriage, withholding amount, etc). Employees who already claimed allowances in previous years do not have to submit this form unless they are claiming an exemption from withholding in section 2. Web printable forms for claimants. • they are. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable. Sign online button or tick the preview image of the form. Details on how to only prepare and print a montana 2022 tax return. To begin the form, use the fill camp; Are a newly hired employee, or claim to be exempt. If too much is withheld, you will generally be due a refund. Employees who already claimed allowances in previous years do not have to submit this form unless they are claiming an exemption from withholding in section 2. Montana state income tax forms for tax year 2022 (jan. Provide all the numbers of the id. We also updated our digital. Therefore, exemption from withholding for federal purposes does not exempt you from montana income tax withholding. Montana state income tax forms for tax year 2022 (jan. 2023 city of billings employees benefit plan document and summary of benefits & coverages. You must fill out new forms if your information changes (marriage, withholding amount, etc). 2023 annual wellness exam incentive program. Hours & earnings worksheet 5/3/21. Ui claimants are required to report hours worked and earnings received during the week when. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Montana state income tax forms for tax year 2022 (jan. Web how you can complete the w9 form 2022. 2023 city of billings employees benefit plan document and summary of benefits & coverages. Sign online button or tick the preview image of the form. • they are a newly hired employee, or • they are claiming to be exempt from montana income tax withholding. Enter the tax year for which you are filing in the box at the top. If too much is withheld, you will generally be due a refund. Therefore, exemption from withholding for federal purposes does not exempt you from montana income tax withholding. Montana state income tax forms for tax year 2022 (jan. Carol does not have a job, but she also receives another pension for $25,000 a year (which Web how you can complete. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. • they are a newly hired employee, or • they are claiming to be exempt from montana income tax withholding. Sign online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable pdf template. If too much is withheld, you will generally be due a refund. Ui claimants are required to report hours worked and earnings received during the week when. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Hours & earnings worksheet 5/3/21. Employees who already claimed allowances in previous years do not have to submit this form unless they are claiming an exemption from withholding in section 2. Your withholding is subject to review by the irs. Employees who already claimed allowances in previous years do not have to submit this form unless they are claiming an exemption from withholding in section 2. Enter the tax year for which you are filing in the box at the top of the form. Web printable forms for claimants. To begin the form, use the fill camp; We also updated our digital platform to include custom forms for every state’s withholding form. Web download the withholding tax guide with montana withholding tax tables. If too much is withheld, you will generally be due a refund. Healthy is wellness incentive flier. 2023 annual wellness exam incentive program form. 2023 city of billings employees benefit plan document and summary of benefits & coverages. Details on how to only prepare and print a montana 2022 tax return. Web printer friendly version 42.17.111 montana income tax withholding; If too much is withheld, you will generally be due a refund. 2023 annual wellness exam incentive program form. Employees who already claimed allowances in previous years do not have to submit this form unless they are claiming an exemption from withholding in section 2. Carol does not have a job, but she also receives another pension for $25,000 a year (which Hours & earnings worksheet 5/3/21. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Enter the tax year for which you are filing in the box at the top of the form. The advanced tools of the editor will direct you through the editable pdf template. Sign online button or tick the preview image of the form. Web how you can complete the w9 form 2022 montana online: We also updated our digital platform to include custom forms for every state’s withholding form. Montana state income tax forms for tax year 2022 (jan. An exemption from withholding is available only if the entire statement you checked in section 2 is true. Web this form allows each employee to claim allowances or an exemption to montana wage withholding when applicable.Irs Form W4V Printable

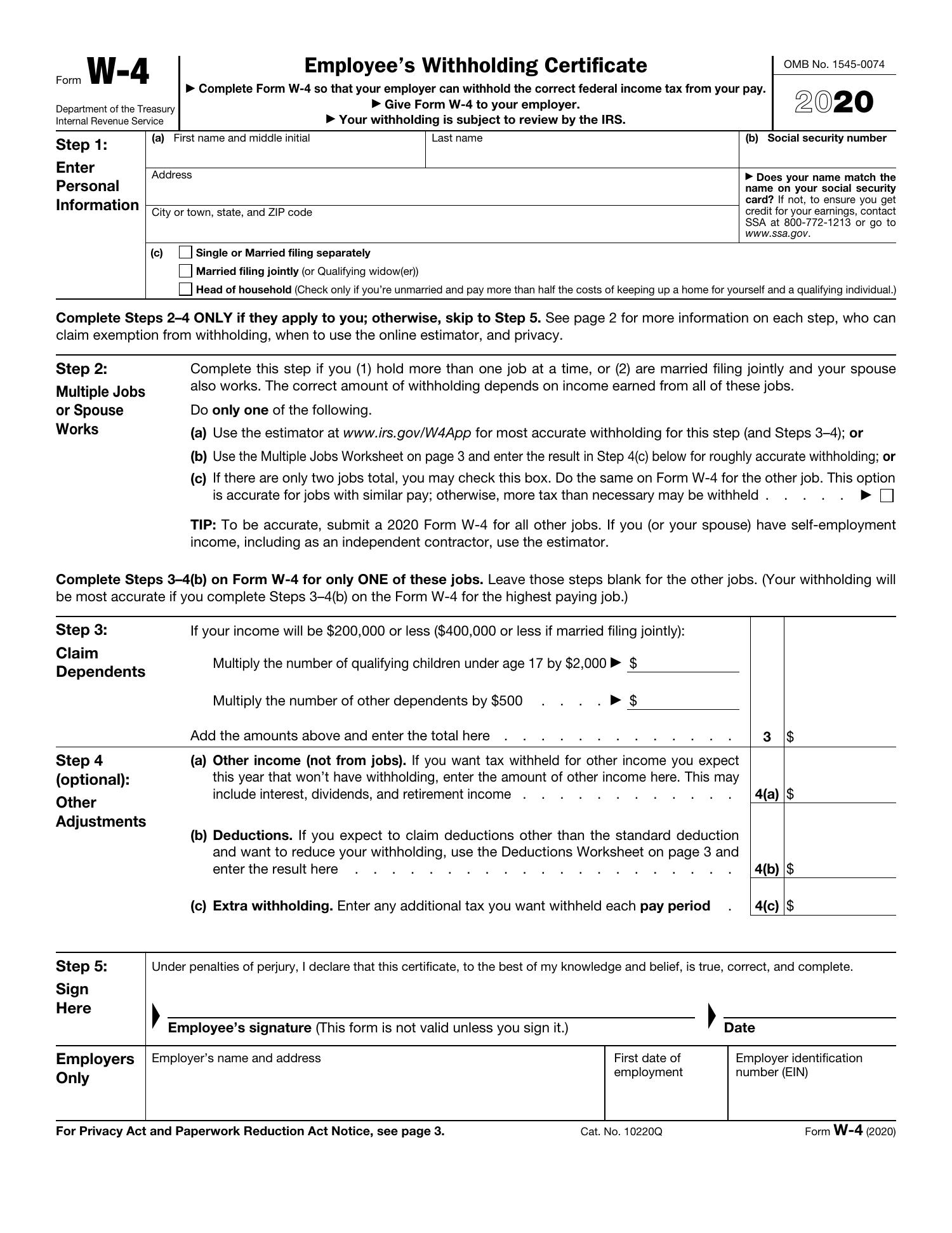

Form W4 2020.pdf DocDroid

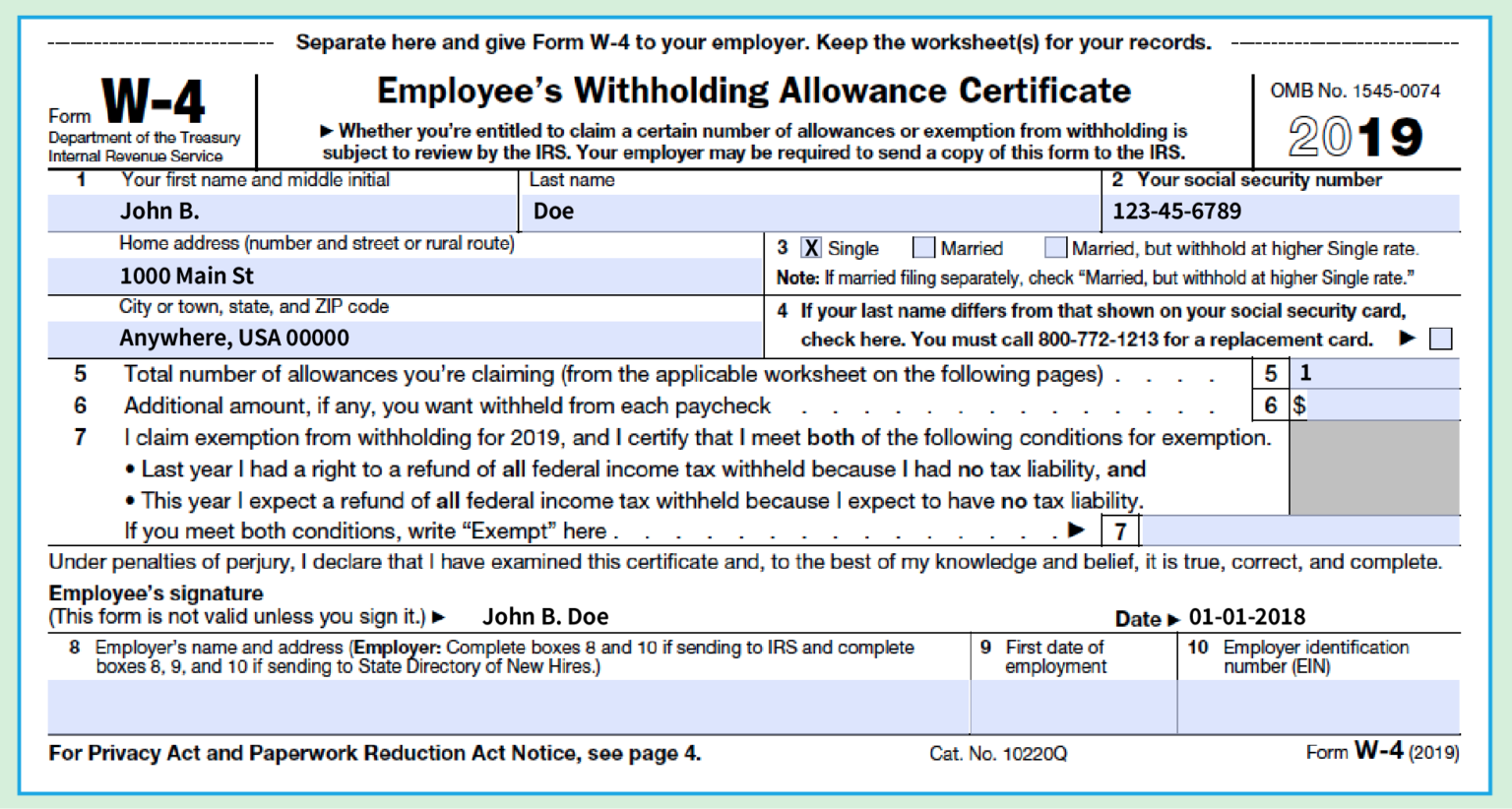

Adjust Your Payroll Withholding with Form W4 Accounting NorthWest, PA

Download Montana 2013 Form W4 for Free FormTemplate

How To Fill Out A W 4 Form The Only Guide You Need W4 2020 Form Printable

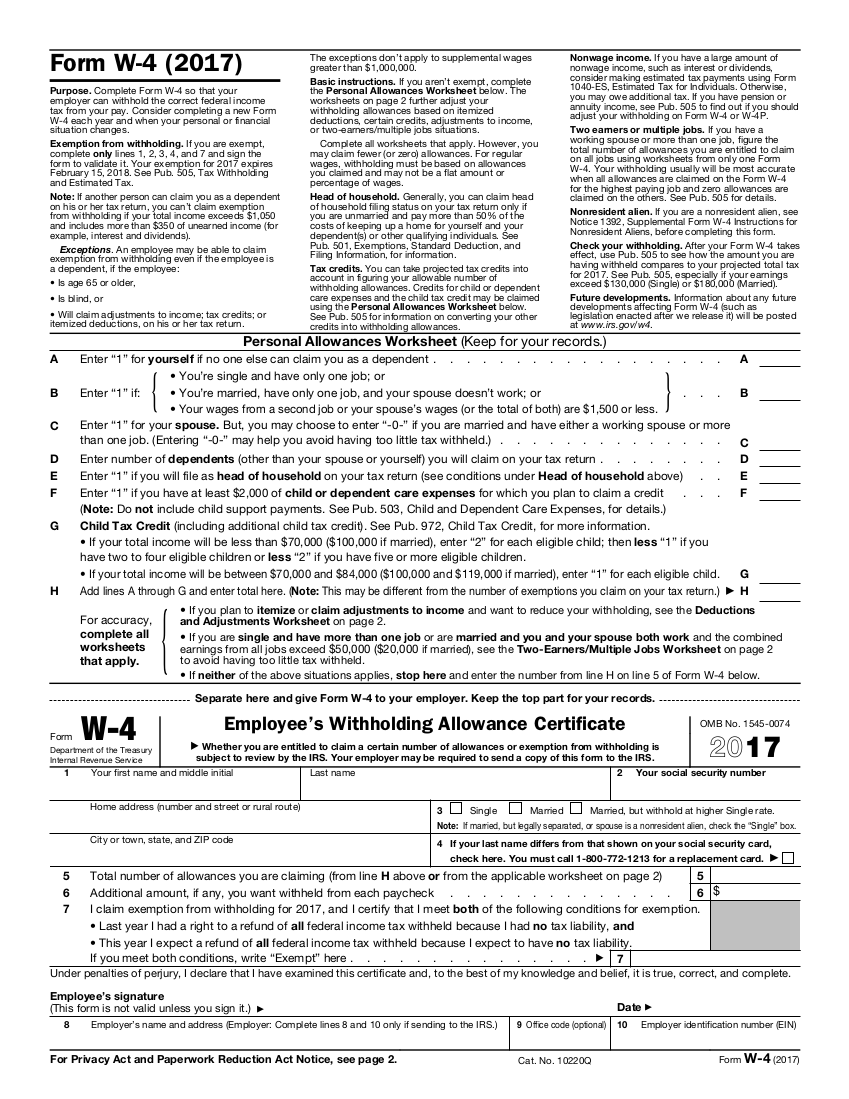

Form W4 2017 Printable 2022 W4 Form

W4 Form 2018 Printable Ezzy W4 Form 2021 Printable

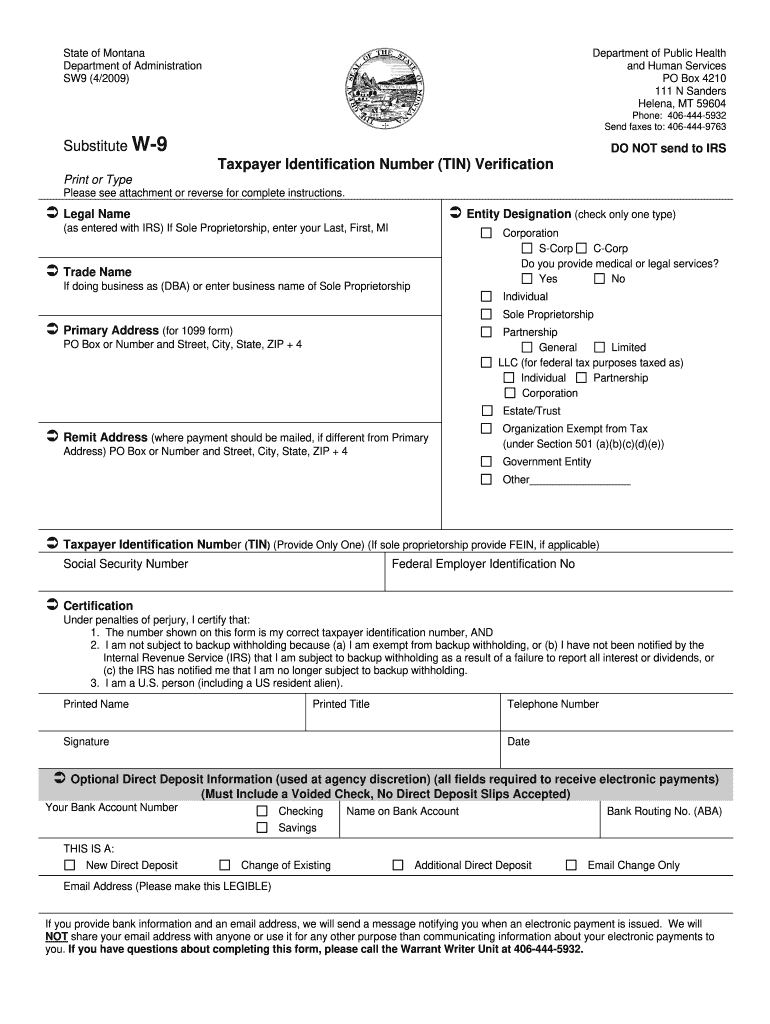

Montana w 9 form Fill out & sign online DocHub

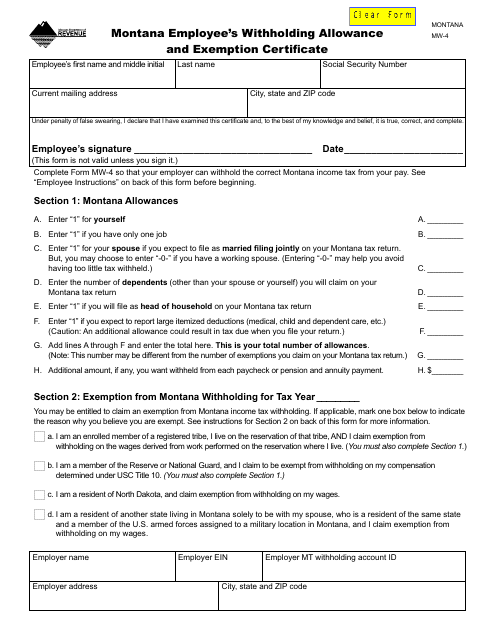

Form MW4 Download Fillable PDF or Fill Online Montana Employee's

W4

Provide All The Numbers Of The Id.

Therefore, Exemption From Withholding For Federal Purposes Does Not Exempt You From Montana Income Tax Withholding.

Your Withholding Is Subject To Review By The Irs.

2023 City Of Billings Employees Benefit Plan Document And Summary Of Benefits & Coverages.

Related Post: