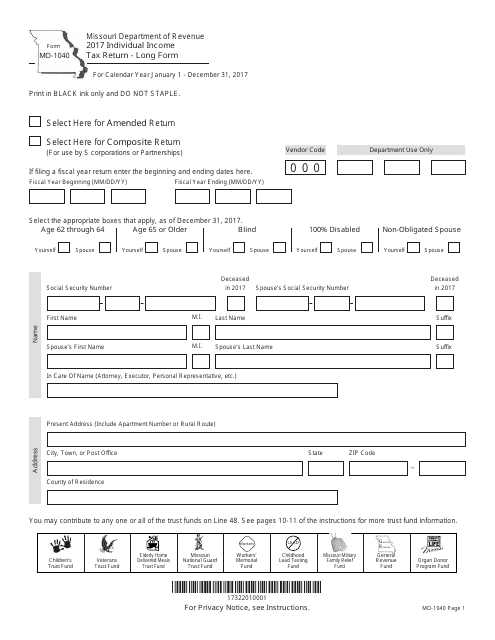

Mo 1040 Printable Form

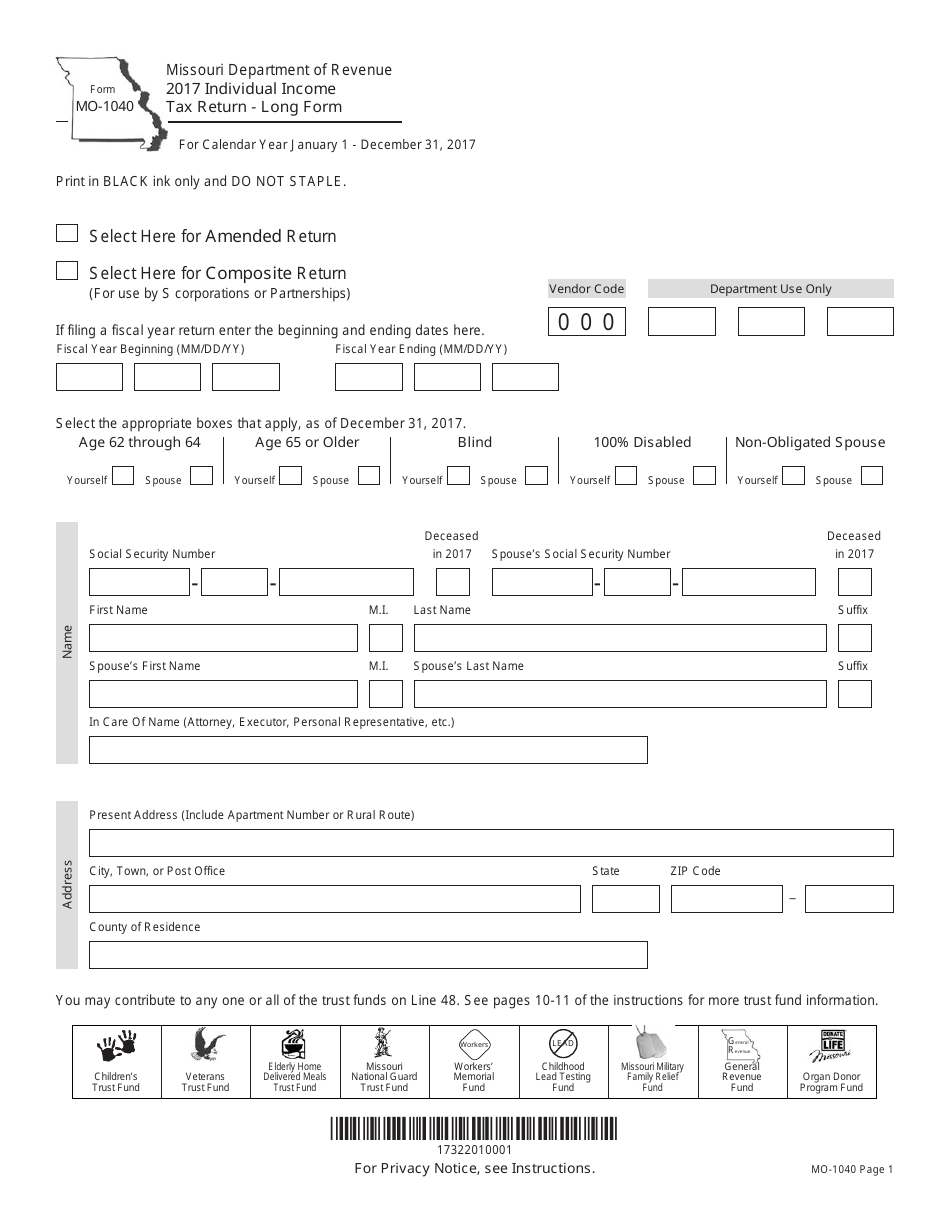

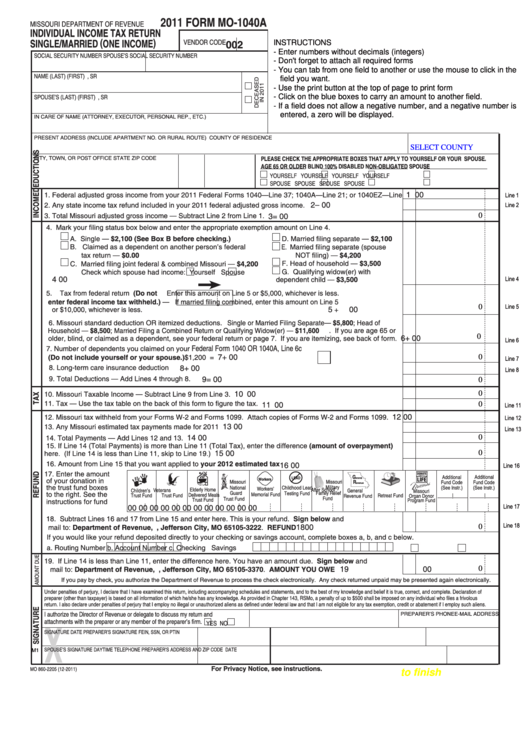

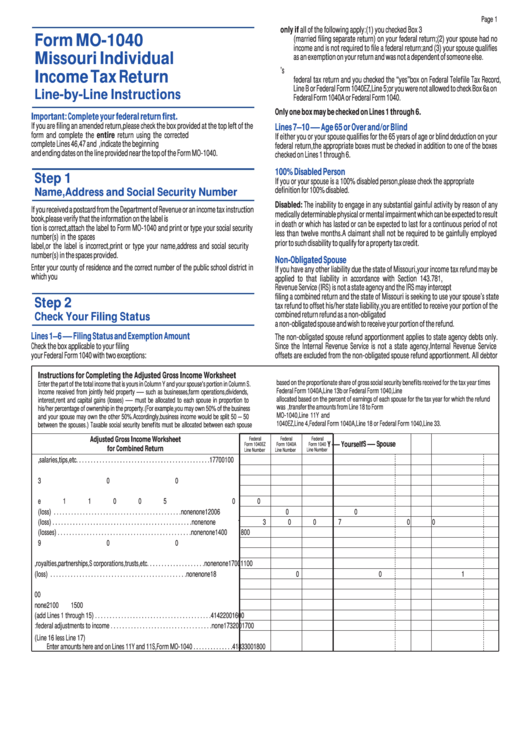

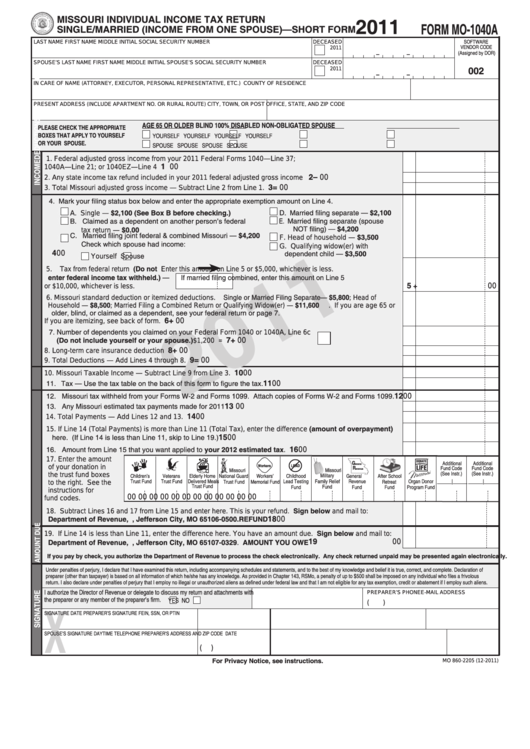

Mo 1040 Printable Form - It is a universal form that can be used by any taxpayer. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. You can print other missouri tax forms here. The short forms are less complicated and provide only the We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri. This form is for income earned in tax year 2022, with tax returns due in april 2023. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) All forms are printable and downloadable. It is a universal form that can be used by any individual taxpayer. The short forms are less complicated and provide only the Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri government. Once completed you can sign your fillable form or send for signing. Use. This form is for income earned in tax year 2022, with tax returns due in april 2023. If you do not have any of the special filing situations described below and you choose to file a paper tax return, try filing a short form. Printable missouri state tax forms for the 2022 tax year will be based on income earned. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. The short forms are less complicated and provide only the Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. All forms are printable and downloadable. For more information about the missouri income tax, see the missouri income tax page. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. You can print other missouri tax forms here. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. You can print other missouri tax forms here. The short forms are less complicated and provide only the Use fill to complete blank online missouri pdf forms for free. All missouri short forms allow the standard or itemized deduction. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri. All forms are printable and downloadable. Single married filing jointly married filing separately (mfs) head of household. It is a universal form that can be used by any individual taxpayer. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! This form is for income earned in tax year 2022, with tax returns due in april 2023. Fiscal year. All forms are printable and downloadable. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Individual income tax return 2022 department of the treasury—internal revenue service omb no. This form is for income earned in tax year 2022, with tax returns due in april 2023.. This form is for income earned in tax year 2022, with tax returns due in april 2023. Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. It is a universal form that can be used by any taxpayer. It is a universal form that can be used by any individual taxpayer. Use fill to complete blank online. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) Complete your federal return first. You must file your taxes yearly by april 15. It is a universal form that can be used by any individual taxpayer. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply. For more information about the missouri income tax, see the missouri income tax page. It is a universal form that can be used by any taxpayer. This form is for income earned in tax year 2022, with tax returns due in april 2023. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. It is a universal form that can be used by any individual taxpayer. Complete your federal return first. The short forms are less complicated and provide only the We will update this page with a new version of the form for 2024 as soon as it is made available by the missouri. All forms are printable and downloadable. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Use fill to complete blank online missouri pdf forms for free. This form is for income earned in tax year 2022, with tax returns due in april 2023. Individual income tax return 2022 department of the treasury—internal revenue service omb no. Filing status check only one box. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. All forms are printable and downloadable. You must file your taxes yearly by april 15. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. Print or type your name(s), address, and social security number( s) in the spaces provided on. It is a universal form that can be used by any taxpayer. You must file your taxes yearly by april 15. You can print other missouri tax forms here. It is a universal form that can be used by any individual taxpayer. This form is for income earned in tax year 2022, with tax returns due in april 2023. Once completed you can sign your fillable form or send for signing. Choose continue and we'll ask you a series of questions to lead you to a simplified form that will reduce the time it takes to complete your return! Fiscal year beginning (mm/dd/yy) fiscal year ending (mm/dd/yy) age 62 through 64. All forms are printable and downloadable. The missouri income tax rate for tax year 2022 is progressive from a low of 1.5% to. Web short forms help you avoid becoming confused by tax laws and procedures that do not apply to you. Printable missouri state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Filing status check only one box. Use fill to complete blank online missouri pdf forms for free. The short forms are less complicated and provide only theForm MO1040 Download Printable PDF or Fill Online Individual

Top 5 Missouri Form Mo1040 Templates free to download in PDF format

MO1040A Fillable Calculating 2015 PDF Tax Refund Social Security

Form Mo1040 Missouri Individual Tax Return printable pdf download

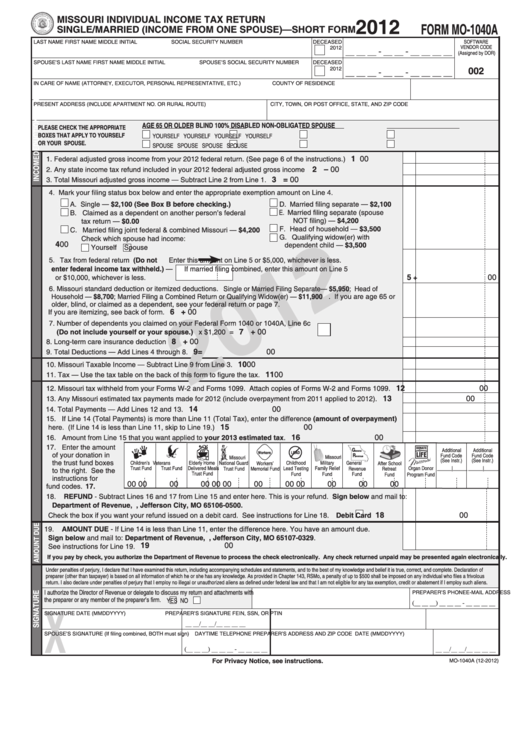

Form Mo1040a Missouri Individual Tax Return Single/married

Form Mo1040a Missouri Individual Tax Return Single/married

Fillable Form Mo 1040 Individual Tax Return 2021 Tax Forms

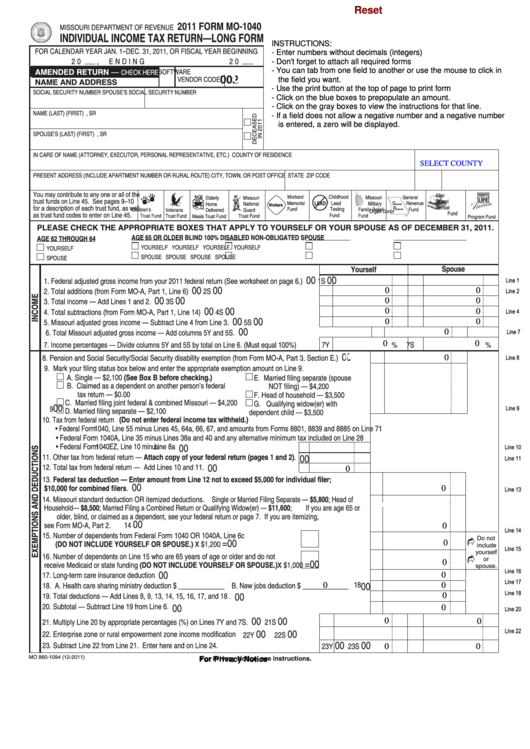

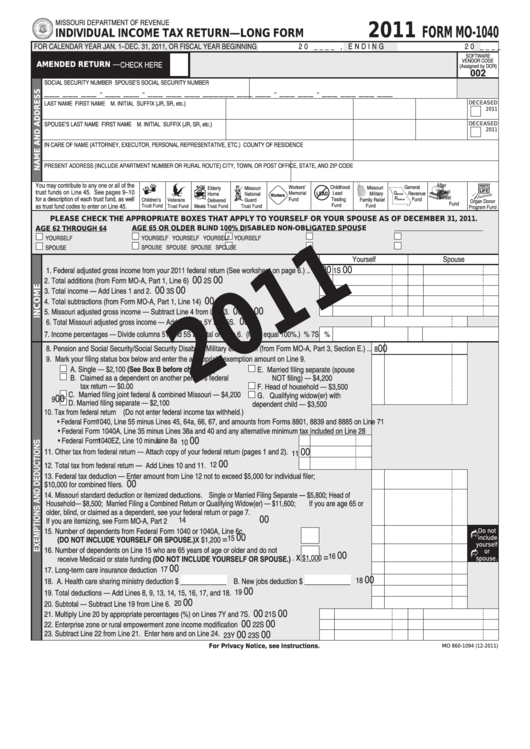

Form Mo1040 Individual Tax Return Long Form 2011

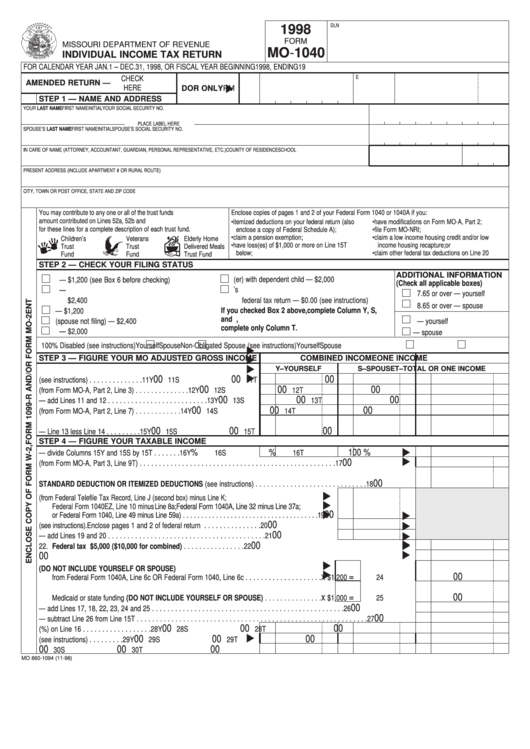

Fillable Form Mo1040 Individual Tax Return 1998 printable

Form MO1040 Download Printable PDF or Fill Online Individual

We Will Update This Page With A New Version Of The Form For 2024 As Soon As It Is Made Available By The Missouri.

Once Completed You Can Sign Your Fillable Form Or Send For Signing.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April 2023.

For More Information About The Missouri Income Tax, See The Missouri Income Tax Page.

Related Post: