Lbo Excel Template

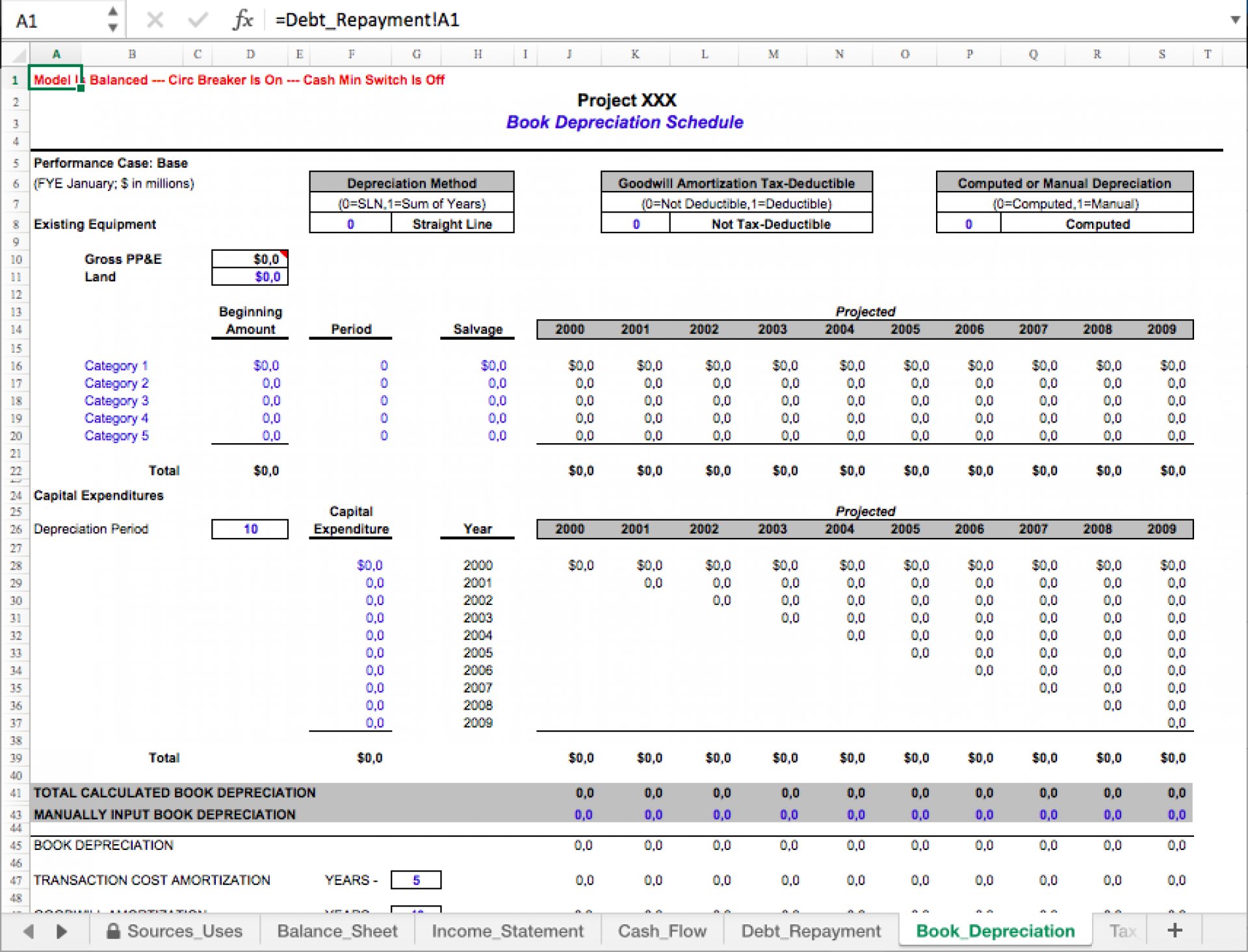

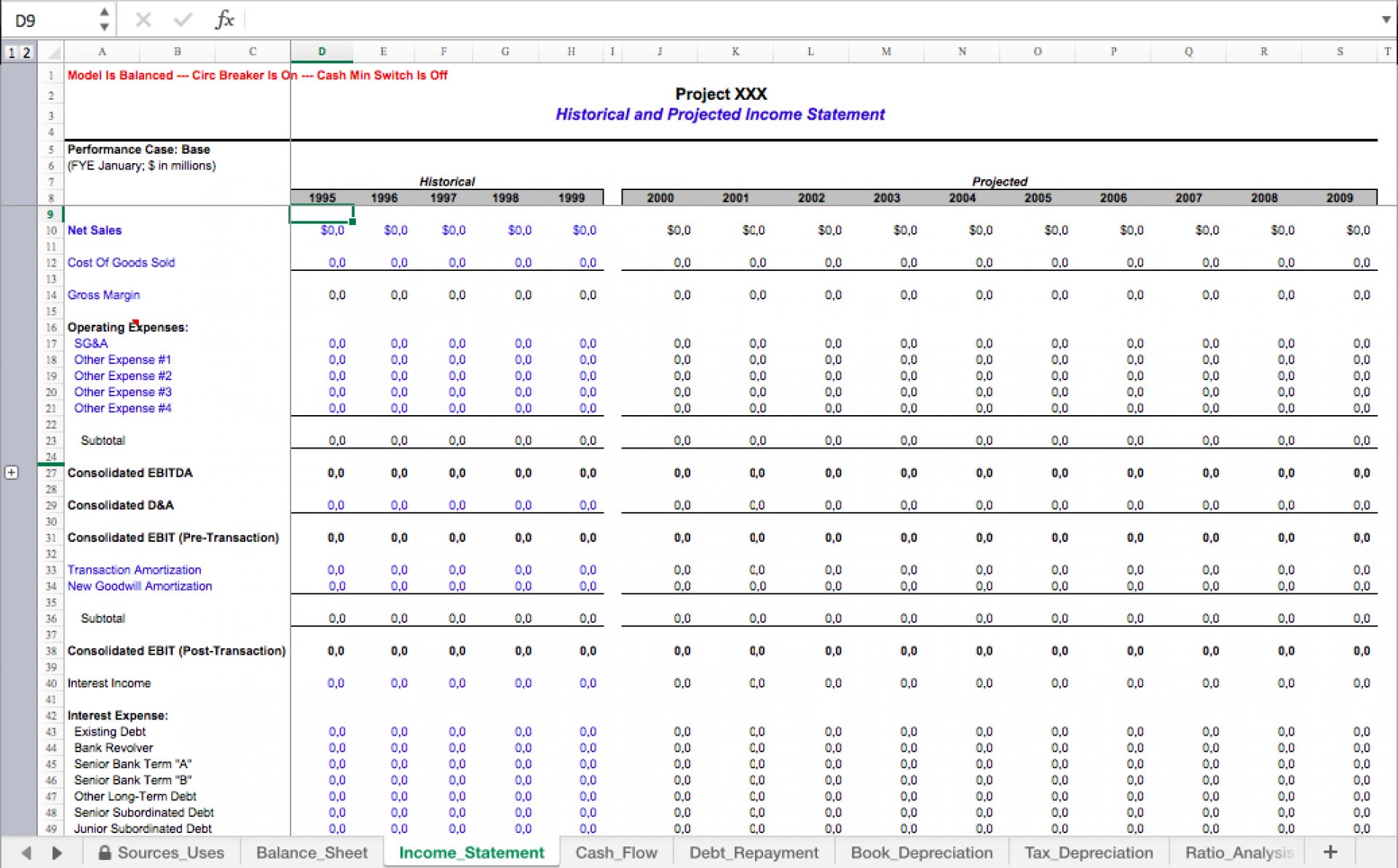

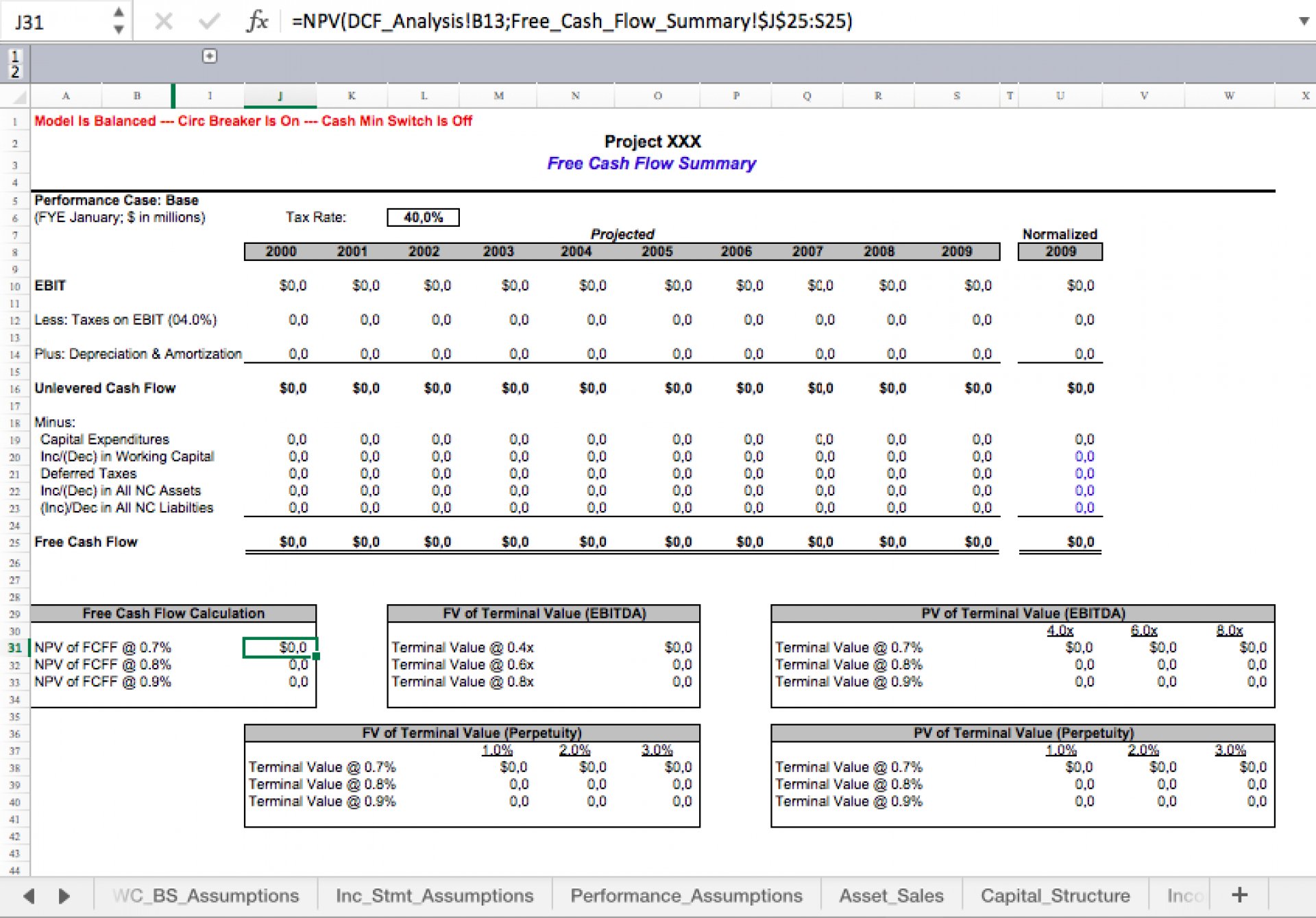

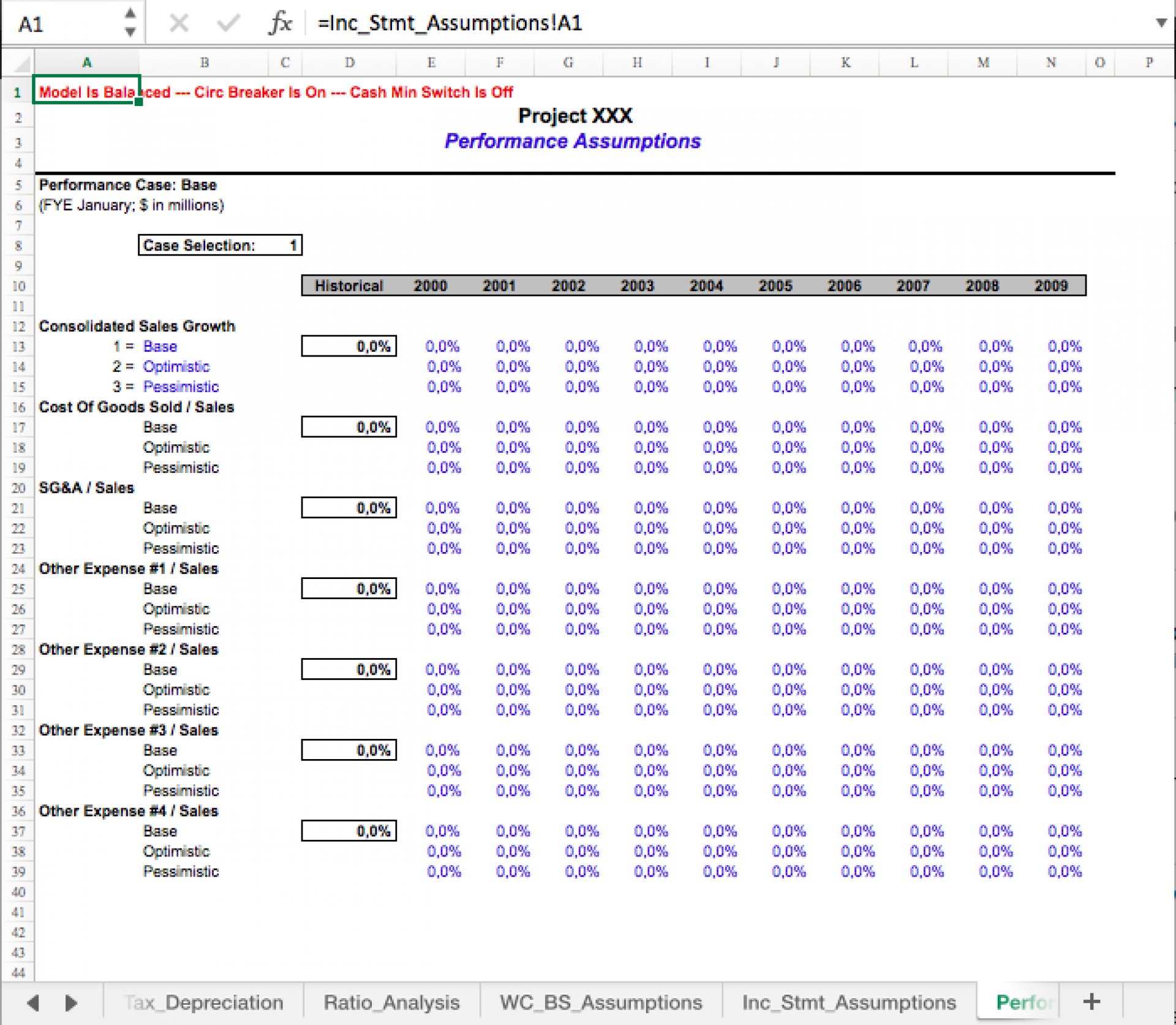

Lbo Excel Template - We believe it sets a new standard for balancing complexity and intuitive use among lbo models. Web what is an lbo model? An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. The ones with templates tend to have more complex formulas, and the ones where you start from scratch have simpler formulas but are more challenging to finish under time pressure. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. The two main categories are tests that give you an excel template and tests in which you start from a blank sheet. Both the assets of a company being acquired and those of the acquiring company are used as collateral for the financing. Web in this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. In this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and valuation assumptions, in excel. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. We believe it sets a new standard for balancing complexity and intuitive use among lbo models. However, while most firms will provide the financials in an excel format that you could use as a “guiding” template, you should still be comfortable with. Web what to expect in a timed lbo modeling test. However, while most firms will provide the financials in an excel format that you could use as a “guiding” template, you should still be comfortable with creating a model starting from scratch. Throughout the tutorial, a baseline understanding of the theory behind leveraged buyouts (lbos) will be assumed. This matters. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Use the form below to download the excel file used to complete the modeling test. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration.. An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. Both the assets of a company being acquired and those of the acquiring company are used as collateral for the financing. Throughout the tutorial, a baseline. Web what is an lbo model? An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. The two main categories are tests that give you an excel template and tests in which you start from a. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. This matters because in many cases, they’ll ask you to calculate numbers such as irr and multiple of invested capital very quickly and will not actually ask you to. The macabacus long form lbo model is derived from actual lbo models used. Web what is an lbo model? Web in this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. However, while most firms will provide the financials in an excel format that you could use as a “guiding” template, you should. An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. Web what is an lbo model? The ones with templates tend to have more complex formulas, and the ones where you start from scratch have simpler. Web what is an lbo model? In this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and valuation assumptions, in excel. An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. This. An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to. We believe it sets a new standard for balancing complexity and intuitive use among lbo models. The macabacus long form lbo model is derived from actual lbo models used by four bulge bracket investment banks, incorporating the best practices and features of each. An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Use the form below to download the excel file used to complete the modeling test. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web in this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. Both the assets of a company being acquired and those of the acquiring company are used as collateral for the financing. In this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and valuation assumptions, in excel. Web what is an lbo model? The ones with templates tend to have more complex formulas, and the ones where you start from scratch have simpler formulas but are more challenging to finish under time pressure. The two main categories are tests that give you an excel template and tests in which you start from a blank sheet. This matters because in many cases, they’ll ask you to calculate numbers such as irr and multiple of invested capital very quickly and will not actually ask you to. Web what to expect in a timed lbo modeling test. Throughout the tutorial, a baseline understanding of the theory behind leveraged buyouts (lbos) will be assumed. Web download wso's free leveraged buyout (lbo) model template below! These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. However, while most firms will provide the financials in an excel format that you could use as a “guiding” template, you should still be comfortable with creating a model starting from scratch. Web what is an lbo model? These templates are available for free download in microsoft excel, word, and powerpoint formats, as well as pdf files. In this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and valuation assumptions, in excel. The two main categories are tests that give you an excel template and tests in which you start from a blank sheet. The ones with templates tend to have more complex formulas, and the ones where you start from scratch have simpler formulas but are more challenging to finish under time pressure. Web in this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. This matters because in many cases, they’ll ask you to calculate numbers such as irr and multiple of invested capital very quickly and will not actually ask you to. However, while most firms will provide the financials in an excel format that you could use as a “guiding” template, you should still be comfortable with creating a model starting from scratch. Web download wso's free leveraged buyout (lbo) model template below! Use the form below to download the excel file used to complete the modeling test. Web in this article, you’ll find 20 of the most useful merger and acquisition (m&a) templates for business (not legal) use, from planning to valuation to integration. Both the assets of a company being acquired and those of the acquiring company are used as collateral for the financing. The macabacus long form lbo model is derived from actual lbo models used by four bulge bracket investment banks, incorporating the best practices and features of each.Leveraged Buyout (LBO) Model Template Excel Eloquens

Detailed LBO Model Complete Private Equity Leveraged Buyout Analysis

ShortForm LBO Model Course (Excel Template)

LBO (Leveraged Buyout) Excel Model Template Professional Excel Model

Simple LBO Template Excel Model (Leveraged Buyout) Alexander Jarvis

Detailed LBO Model Complete Private Equity Leveraged Buyout Analysis

Simple LBO Template Excel Model (Leveraged Buyout)

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Web What To Expect In A Timed Lbo Modeling Test.

We Believe It Sets A New Standard For Balancing Complexity And Intuitive Use Among Lbo Models.

An Lbo Model Is A Financial Tool Typically Built In Excel To Evaluate A Leveraged Buyout (Lbo) Transaction, Which Is The Acquisition Of A Company That Is Funded Using A Significant Amount Of Debt.

Throughout The Tutorial, A Baseline Understanding Of The Theory Behind Leveraged Buyouts (Lbos) Will Be Assumed.

Related Post: