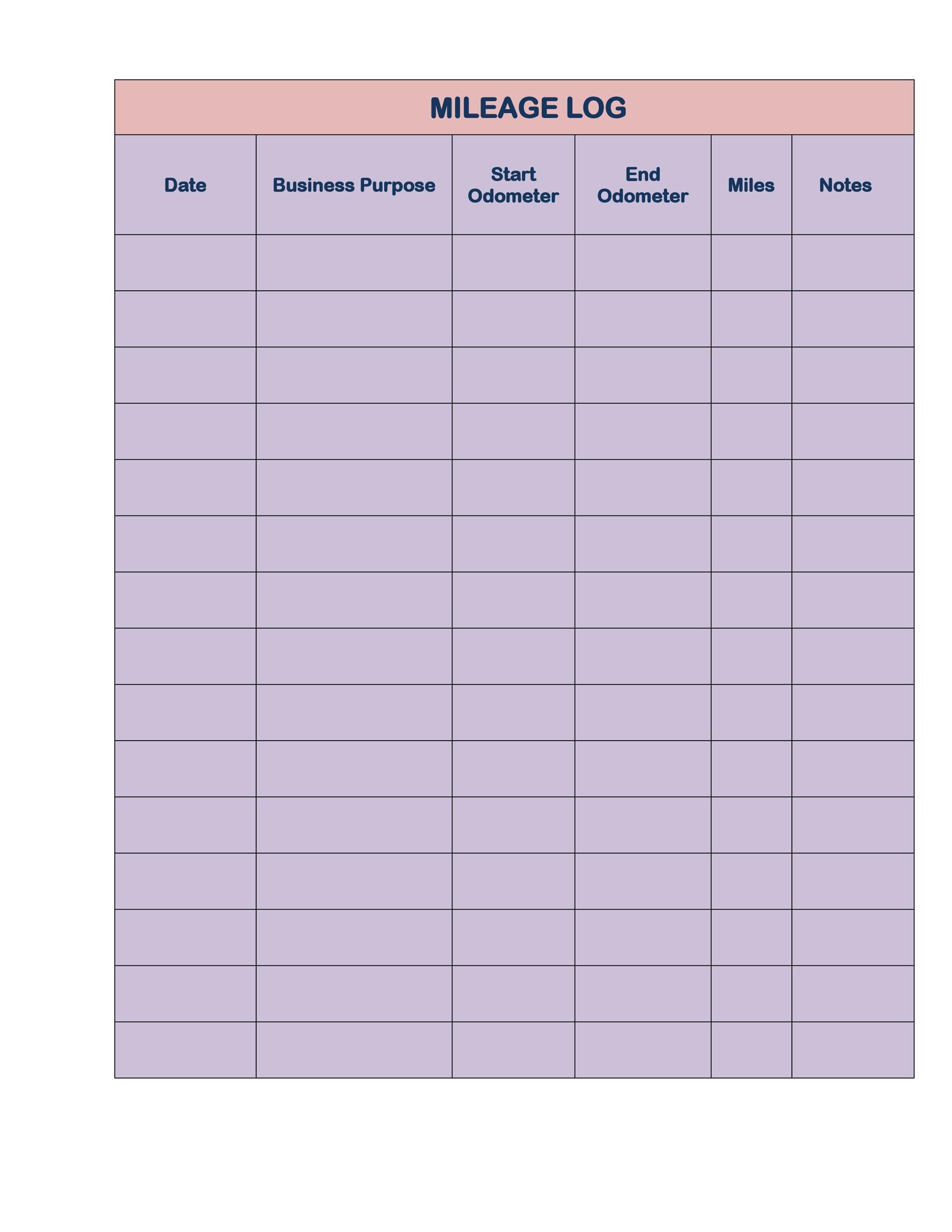

Irs Approved Mileage Log Printable

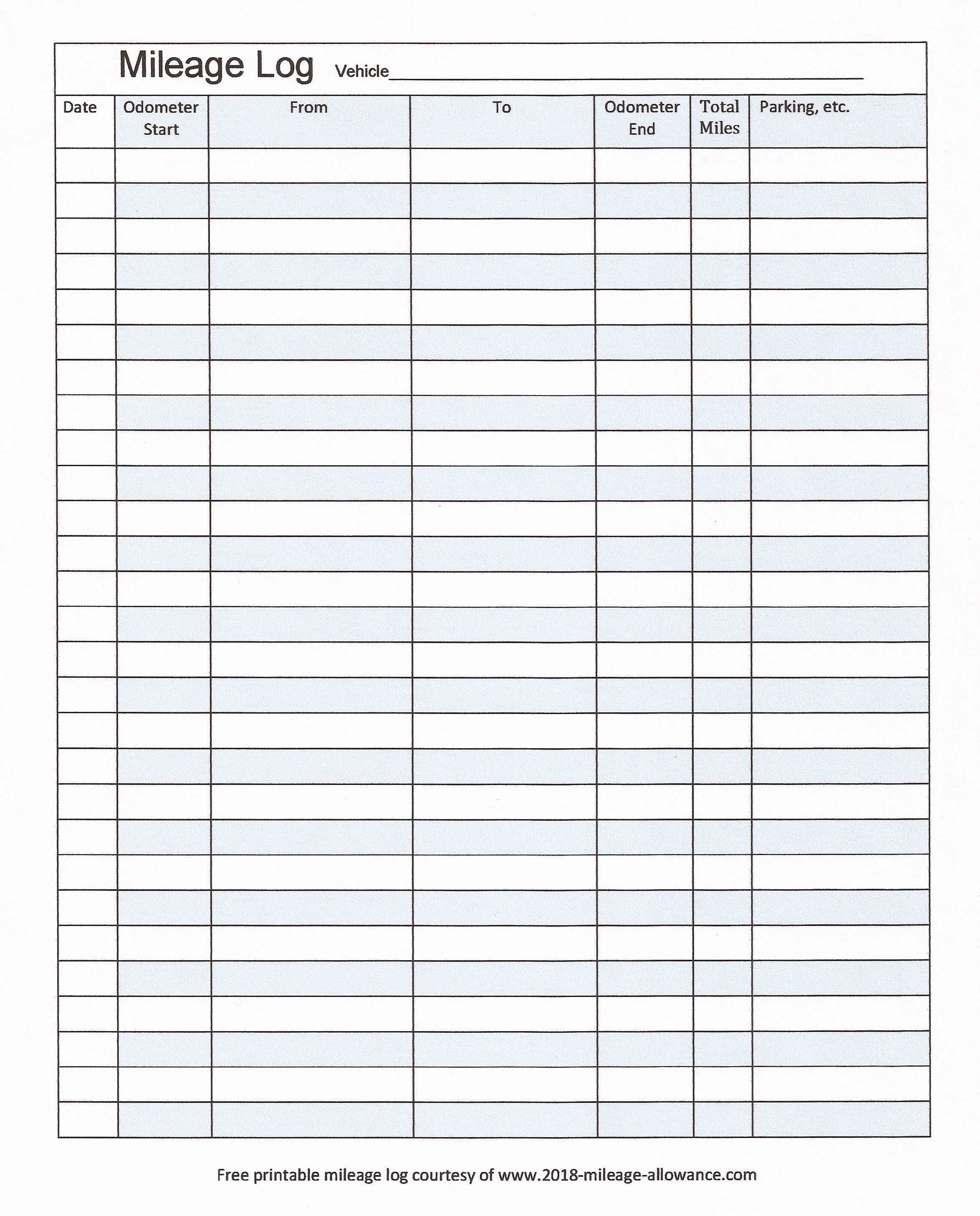

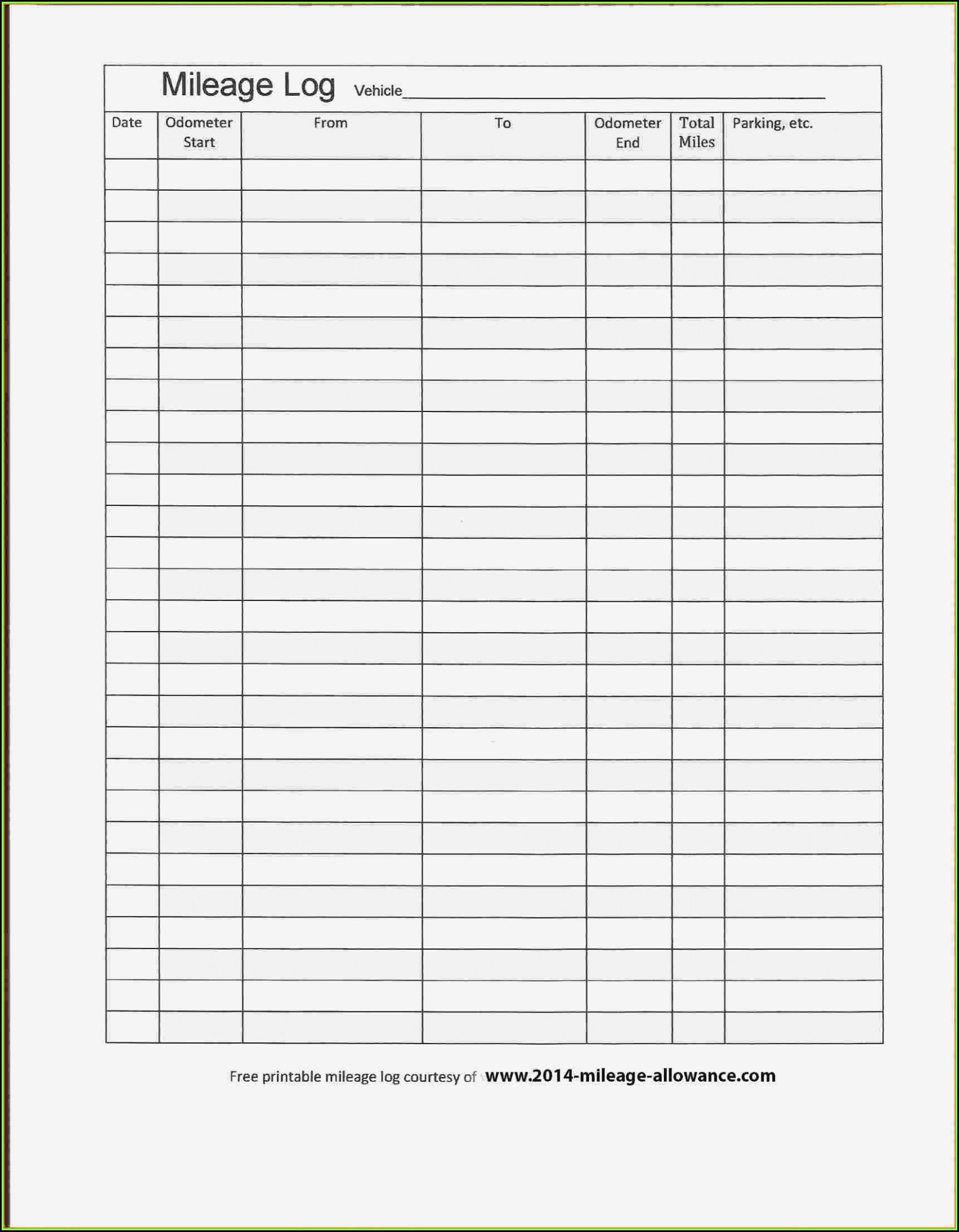

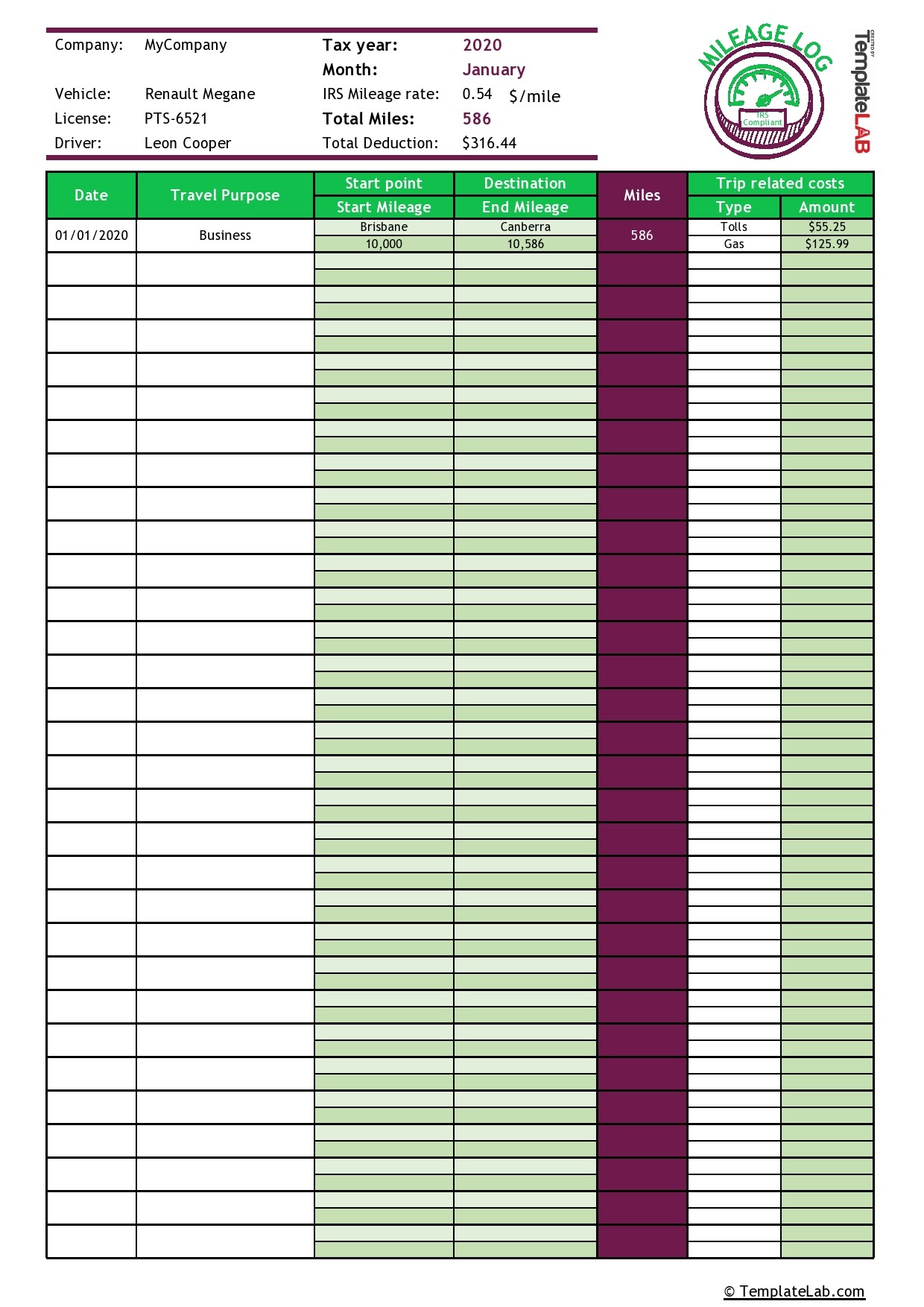

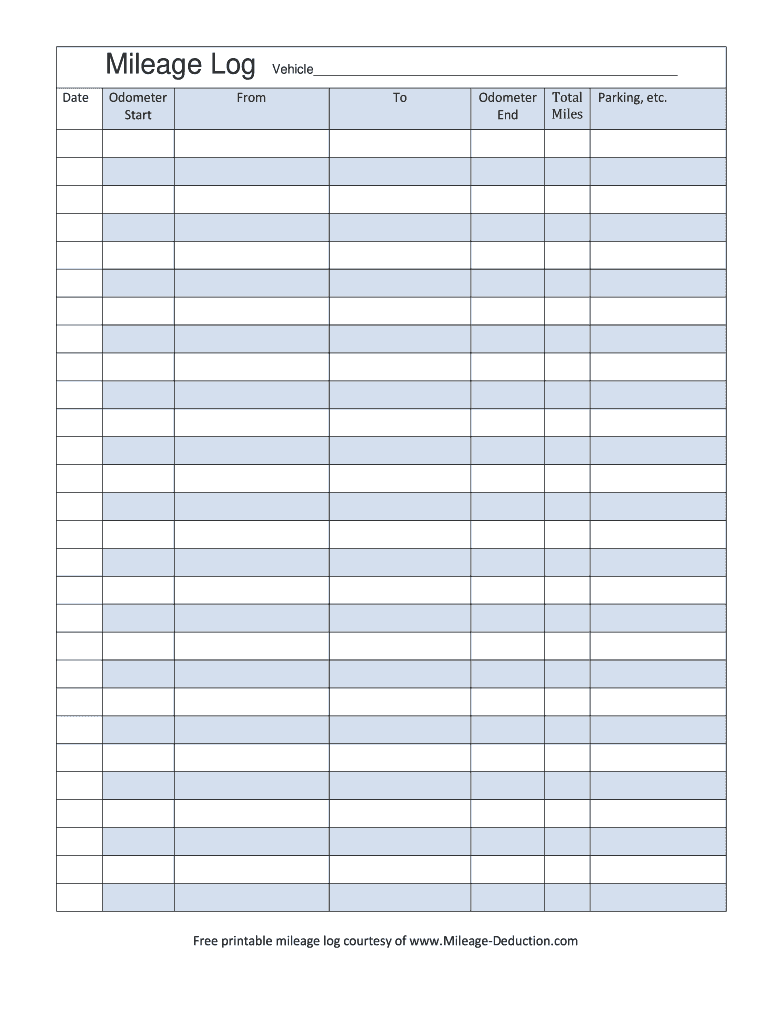

Irs Approved Mileage Log Printable - Remember to use the 2022 irs mileage rate if you log trips for last year. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Depreciation limits on cars, trucks, and vans. Web irs mileage log form total mileage recorded: Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Depreciation limits on cars, trucks, and vans. Www.gofar.co when you’re ready to make life easier, get gofar! All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web our free mileage. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Car expenses and use of the standard mileage rate are explained in chapter 4. Web this free mileage log template tracks your trips. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Web irs mileage log form total mileage recorded: Web this free mileage log template tracks. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web irs mileage log form total mileage recorded: Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Many business owners are able. Fixed and variable rate (favr). Www.gofar.co when you’re ready to make life easier, get gofar! Car expenses and use of the standard mileage rate are explained in chapter 4. Depreciation limits on cars, trucks, and vans. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Remember to use the 2022 irs mileage rate if you log trips for last year. Fixed and variable rate (favr). Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently. Fixed and variable rate (favr). Web irs mileage log form total mileage recorded: All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Car expenses and. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Fixed and variable. Web irs mileage log form total mileage recorded: Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. All in all, it’s a perfect solution for your own taxes — or. Many business owners underestimate how beneficial it is to track their business mileage. Fixed and variable rate (favr). Depreciation limits on cars, trucks, and vans. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Www.gofar.co when you’re ready to make life easier, get. Www.gofar.co when you’re ready to make life easier, get gofar! Fixed and variable rate (favr). Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Many business owners are able to deduct the costs associated with their vehicle, expenses for repairs and the miles it’s driven. Many business owners underestimate how beneficial it is to track their business mileage. Car expenses and use of the standard mileage rate are explained in chapter 4. Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one. Remember to use the 2022 irs mileage rate if you log trips for last year. Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Web irs mileage log form total mileage recorded: Depreciation limits on cars, trucks, and vans. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Web gofar mileage tracker device and a free app to log your miles and expenses automatically with no hassle at all or. Car expenses and use of the standard mileage rate are explained in chapter 4. Hello@gofar.co date time description purpose from to mileage odometer start odometer finish driver’s name and id: Web 20 printable mileage log templates (free) the irs has strict rules about the types of driving that can be deducted from your taxes. Fixed and variable rate (favr). All in all, it’s a perfect solution for your own taxes — or for requesting a mileage reimbursement from a customer or employer. Www.gofar.co when you’re ready to make life easier, get gofar! Many business owners underestimate how beneficial it is to track their business mileage. Depreciation limits on cars, trucks, and vans. Web our free mileage log templates will enable you to comply with all irs regulations, thus allowing you to legally and conveniently deduct business mileage expenses. Web this free mileage log template tracks your trips and automatically calculates your mileage deduction on each one.29+ Free Printable Mileage Logs Sample Templates

20 Printable Mileage Log Templates (Free) ᐅ TemplateLab

Mileage Spreadsheet Uk Google Spreadshee mileage log spreadsheet uk

Free Printable Mileage Log Free Printable A to Z

Irs Mileage Log Form Form Resume Examples xz203EzVql

Downloadable Mileage Log Excel Templates

Free PDF Mileage Logs Printable IRS Mileage Rate 2021

25 Printable Irs Mileage Tracking Templates Gofar With Mileage Report

Editable 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log

30 Printable Mileage Log Templates (Free) Template Lab

Web Irs Mileage Log Form Total Mileage Recorded:

Remember To Use The 2022 Irs Mileage Rate If You Log Trips For Last Year.

Many Business Owners Are Able To Deduct The Costs Associated With Their Vehicle, Expenses For Repairs And The Miles It’s Driven.

Related Post: