508C1A Trust Template

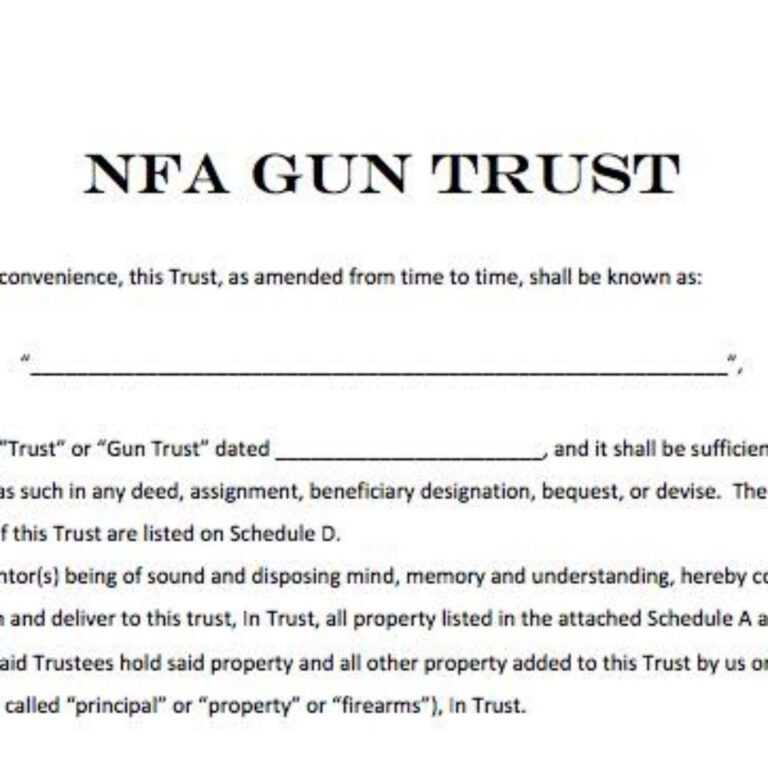

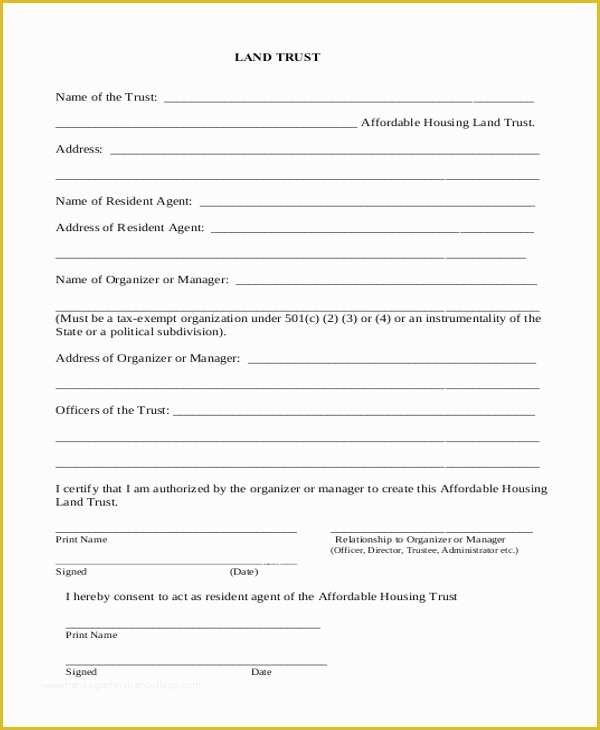

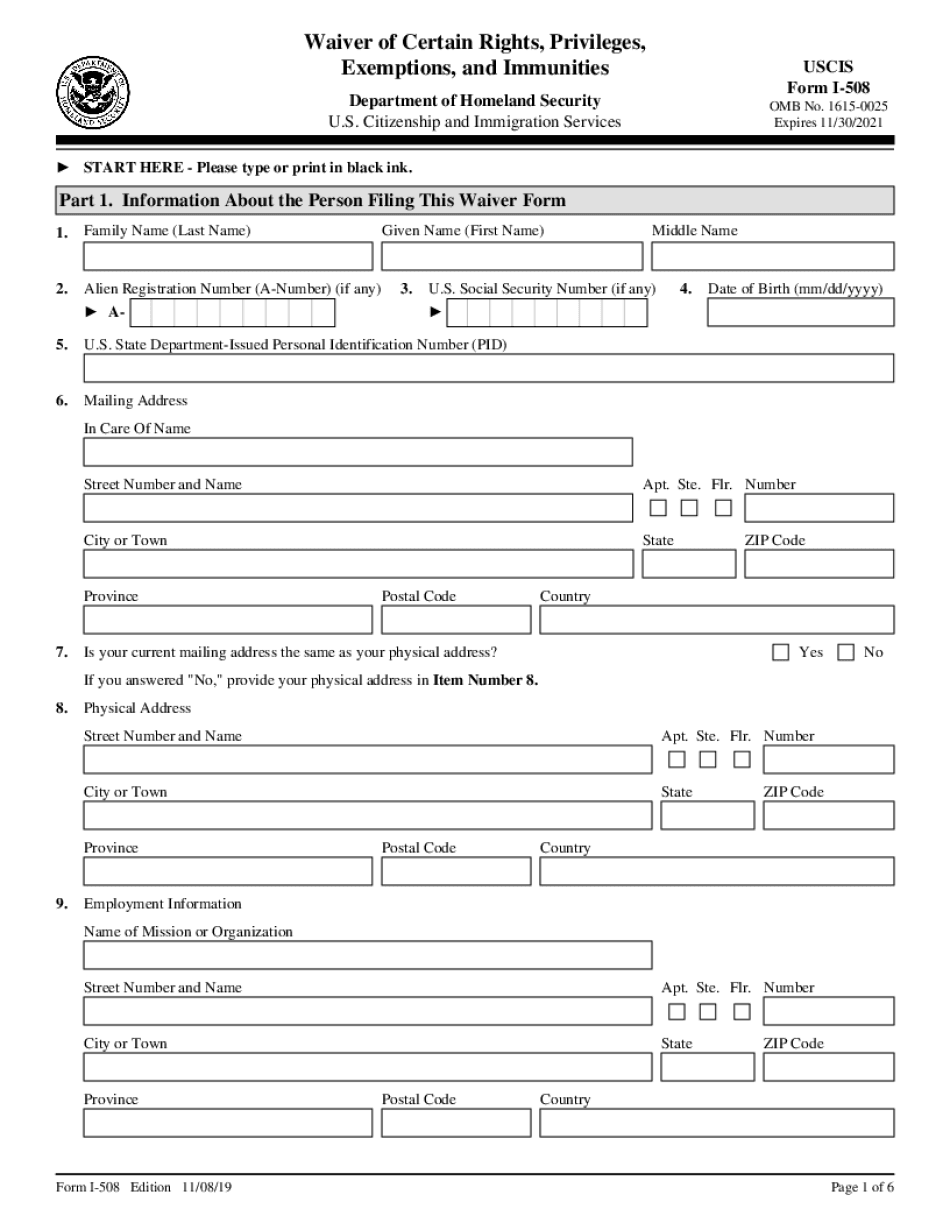

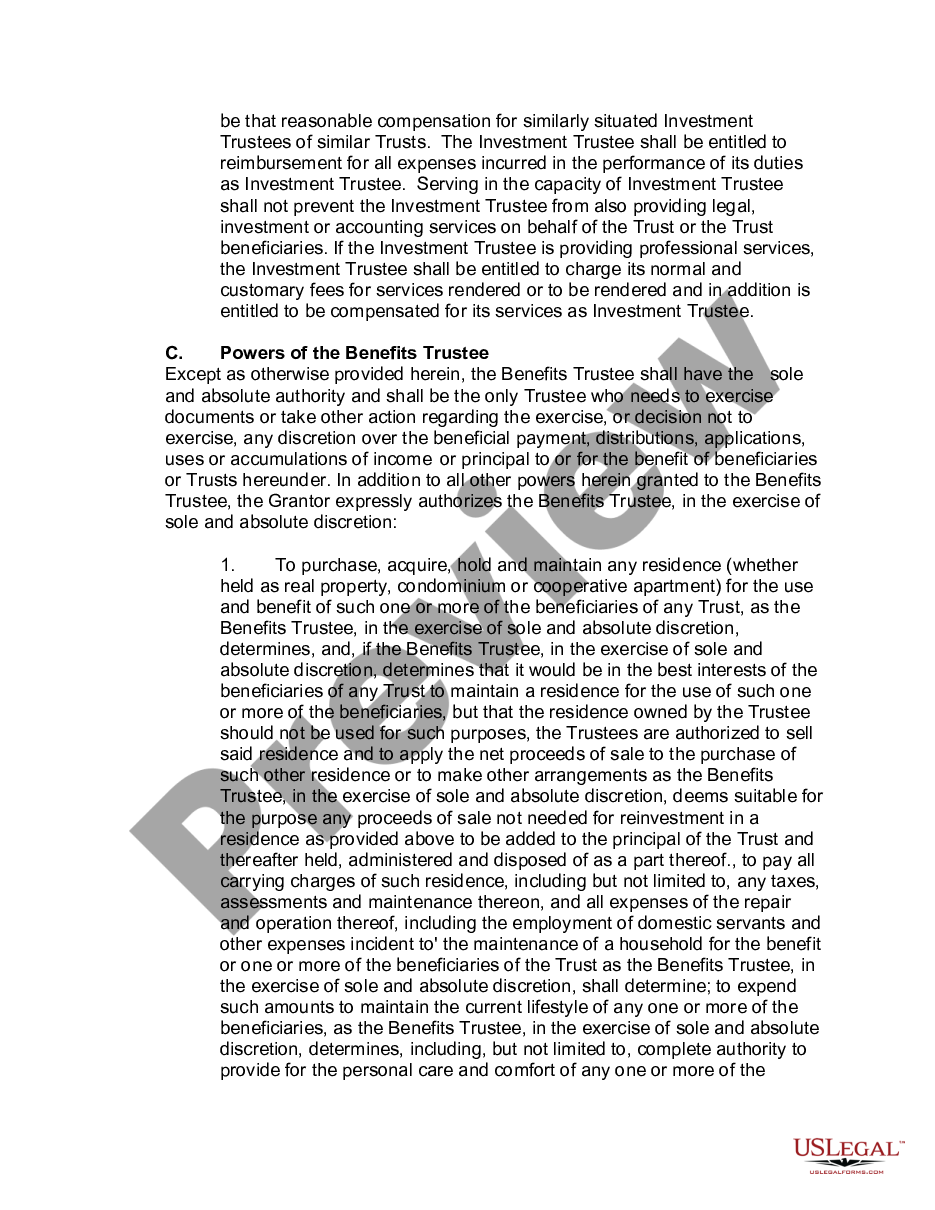

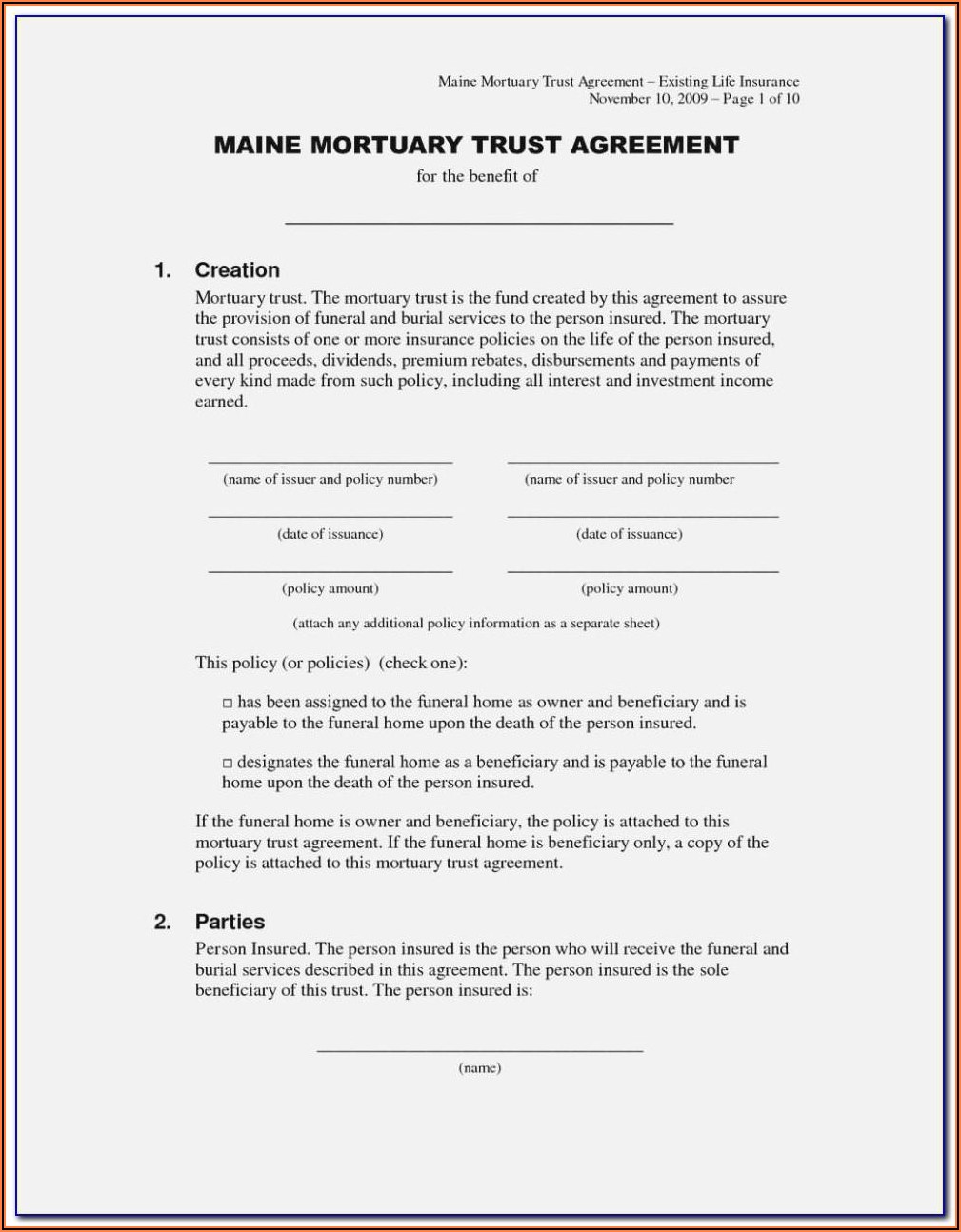

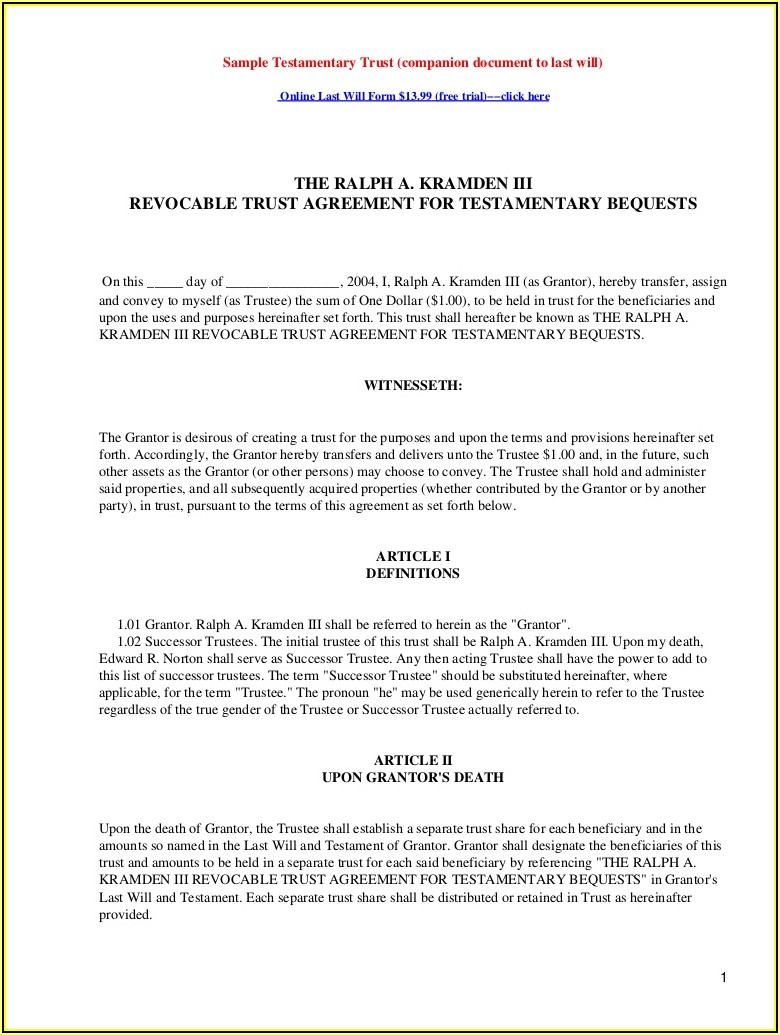

508C1A Trust Template - 508(c)(1)(a) [ private unincorporated irrevocable trust of religious assembly to separate your energy from the. Enjoy smart fillable fields and interactivity. Edit your 508 c 1 a form online. Type text, add images, blackout confidential details, add comments, highlights and more. Web the rights and protections of the 508 (c) (1) (a) faith based organization are confirmed and established by federal law, irs publications, and numerous court cases. Web a 508c1a trust is a trust created under the provisions of section 508c1a of the internal revenue code. Web up to $40 cash back fill 508c1a trust template, edit online. Business, legal, tax along with. 508 (c) (1) (a) organizations are. Web although irc 508(a) does not apply to a trust described in irc 4947(a)(1), it can have the effect of preventing such a trust from obtaining exemption under irc 501(c)(3) for the. Web although irc 508(a) does not apply to a trust described in irc 4947(a)(1), it can have the effect of preventing such a trust from obtaining exemption under irc 501(c)(3) for the. Type text, add images, blackout confidential details, add comments, highlights and more. Do you want to explore the foundational truth about our. Web the rights and protections of. Web many people use the 508 (c) (1) (a) tax exemption to start a free church that provides a complete separation of church and state. Enter all required information in the required fillable fields. Web get your online template and fill it in using progressive features. Web although irc 508(a) does not apply to a trust described in irc 4947(a)(1),. Pick the web sample in the catalogue. 508(c)(1)(a) [ private unincorporated irrevocable trust of religious assembly to separate your energy from the. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Type text, add images, blackout confidential details, add comments, highlights and more. Web follow our easy steps to get your 508c1a trust template ready quickly: Web a 508 (c)1 (a) / fbo (faith based organization) is for religious organizations. Draw your signature, type it,. This type of trust offers many advantages to those who wish. A trust is universally applicable for almost any situation or entity. 508 (c) (1) (a) organizations are. Web although irc 508(a) does not apply to a trust described in irc 4947(a)(1), it can have the effect of preventing such a trust from obtaining exemption under irc 501(c)(3) for the. Edit your 508 c 1 a form online. Web follow our easy steps to get your 508c1a trust template ready quickly: Do you want to explore the foundational. Web the rights and protections of the 508 (c) (1) (a) faith based organization are confirmed and established by federal law, irs publications, and numerous court cases. Start completing the fillable fields and. 508 (c) (1) (a) organizations are. Draw your signature, type it,. Sign it in a few clicks. Web a 508c1a trust is a trust created under the provisions of section 508c1a of the internal revenue code. Start completing the fillable fields and. Pick the web sample in the catalogue. 508(c)(1)(a) [ private unincorporated irrevocable trust of religious assembly to separate your energy from the. Follow the simple instructions below: Web many people use the 508 (c) (1) (a) tax exemption to start a free church that provides a complete separation of church and state. Web up to $40 cash back fill 508c1a trust template, edit online. Type text, add images, blackout confidential details, add comments, highlights and more. Follow the simple instructions below: Draw your signature, type it,. Draw your signature, type it,. Enjoy smart fillable fields and interactivity. Business, legal, tax along with. Start completing the fillable fields and. Web many people use the 508 (c) (1) (a) tax exemption to start a free church that provides a complete separation of church and state. Web follow our easy steps to get your 508c1a trust template ready quickly: Web get your online template and fill it in using progressive features. Sign it in a few clicks. 508 (c) (1) (a) organizations are. Type text, add images, blackout confidential details, add comments, highlights and more. 508 (c) (1) (a) organizations are. Web although irc 508(a) does not apply to a trust described in irc 4947(a)(1), it can have the effect of preventing such a trust from obtaining exemption under irc 501(c)(3) for the. Web get your online template and fill it in using progressive features. Web follow our easy steps to get your 508c1a trust template ready quickly: Enter all required information in the required fillable fields. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web 508c1a trust template are you looking to gain a deeper understanding of the laws that govern our society? Business, legal, tax along with. Do you want to explore the foundational truth about our. A trust is universally applicable for almost any situation or entity. Web a 508c1a trust is a trust created under the provisions of section 508c1a of the internal revenue code. Start completing the fillable fields and. Follow the simple instructions below: Type text, add images, blackout confidential details, add comments, highlights and more. Web up to $40 cash back fill 508c1a trust template, edit online. The 508 (c) (1) (a) fbo is separate and distinct from a 501 (c) (3) charity. Web the rights and protections of the 508 (c) (1) (a) faith based organization are confirmed and established by federal law, irs publications, and numerous court cases. Edit your 508 c 1 a form online. Sign it in a few clicks. Draw your signature, type it,. Do you want to explore the foundational truth about our. Draw your signature, type it,. Enjoy smart fillable fields and interactivity. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web up to $40 cash back fill 508c1a trust template, edit online. 508 (c) (1) (a) organizations are. Enter all required information in the required fillable fields. Type text, add images, blackout confidential details, add comments, highlights and more. This type of trust offers many advantages to those who wish. Start completing the fillable fields and. Pick the web sample in the catalogue. Web a 508 (c)1 (a) / fbo (faith based organization) is for religious organizations. Web 508c1a trust template are you looking to gain a deeper understanding of the laws that govern our society? A trust is universally applicable for almost any situation or entity. Web a 508c1a trust is a trust created under the provisions of section 508c1a of the internal revenue code. Web although irc 508(a) does not apply to a trust described in irc 4947(a)(1), it can have the effect of preventing such a trust from obtaining exemption under irc 501(c)(3) for the.508c1a Trust Template Portal Tutorials

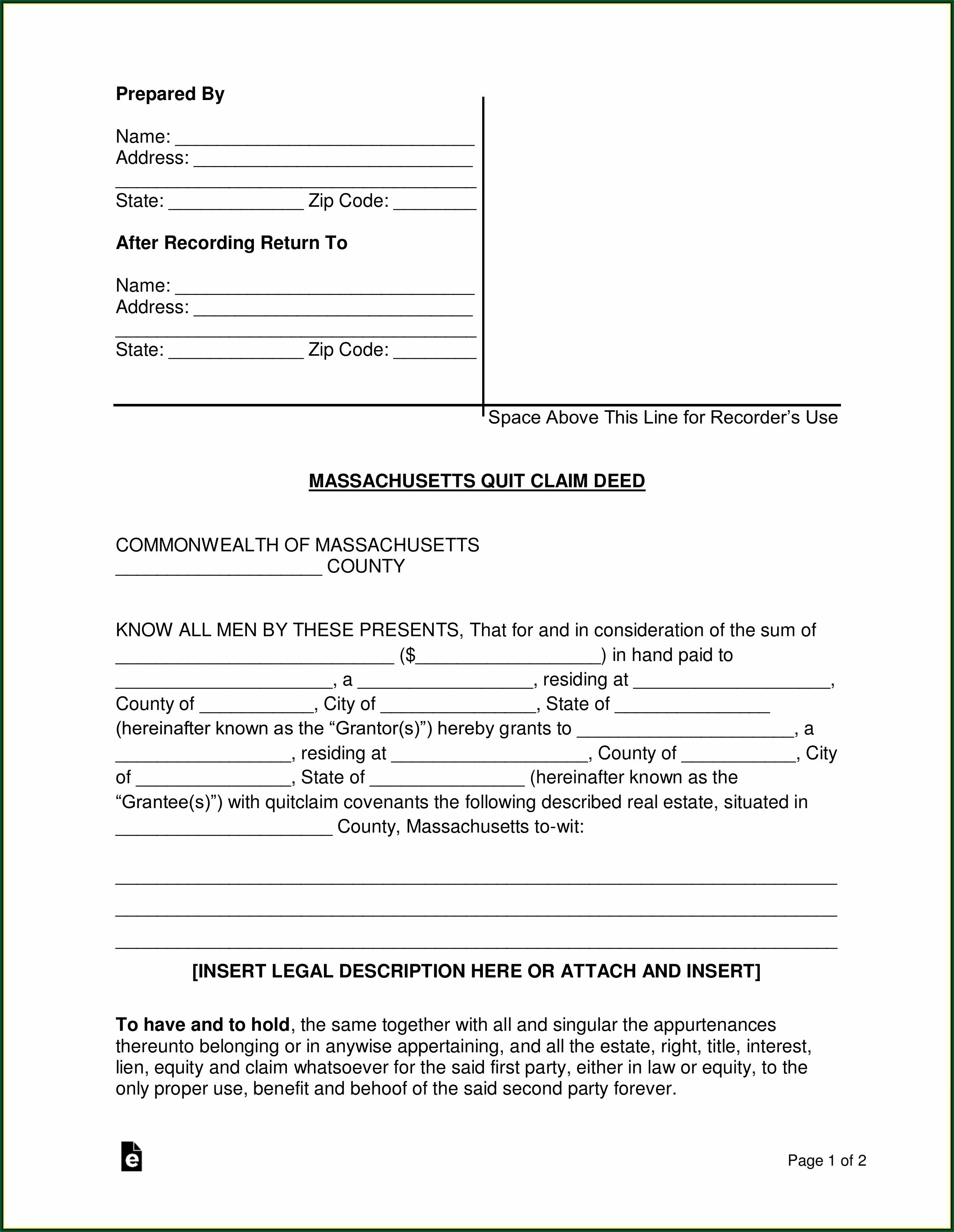

508c1a Trust Template to start your own unincorporated Private

508c1a Trust Template Portal Tutorials

508(c)(1)(a) application Fill Online, Printable, Fillable Blank

508c1a Trust Template Portal Tutorials

508c1a Trust Template Portal Tutorials

508c1a Trust Template Portal Tutorials

Lic 508 Fill Online, Printable, Fillable, Blank pdfFiller

508c1a Trust Template Portal Tutorials

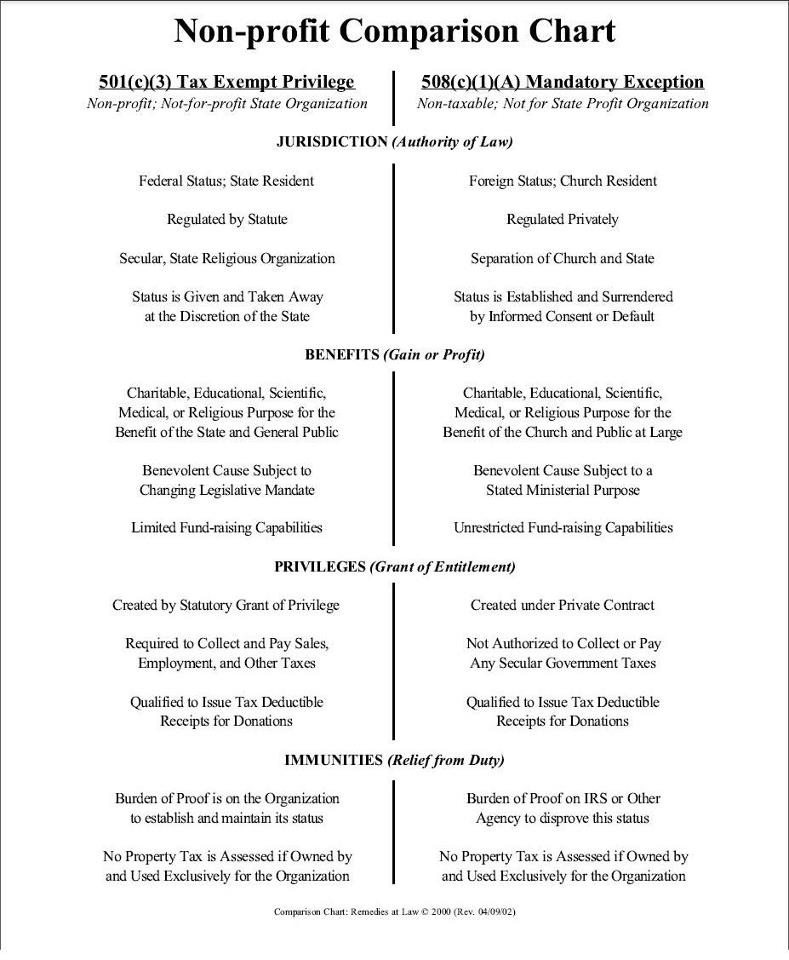

INQUISITION NEWS 501c3 & 508c1a comparison Chart taken from

Use Get Form Or Simply Click On The Template Preview To Open It In The Editor.

Web Follow Our Easy Steps To Get Your 508C1A Trust Template Ready Quickly:

Web Get Your Online Template And Fill It In Using Progressive Features.

The 508 (C) (1) (A) Fbo Is Separate And Distinct From A 501 (C) (3) Charity.

Related Post: