2017 W 9 Printable Form

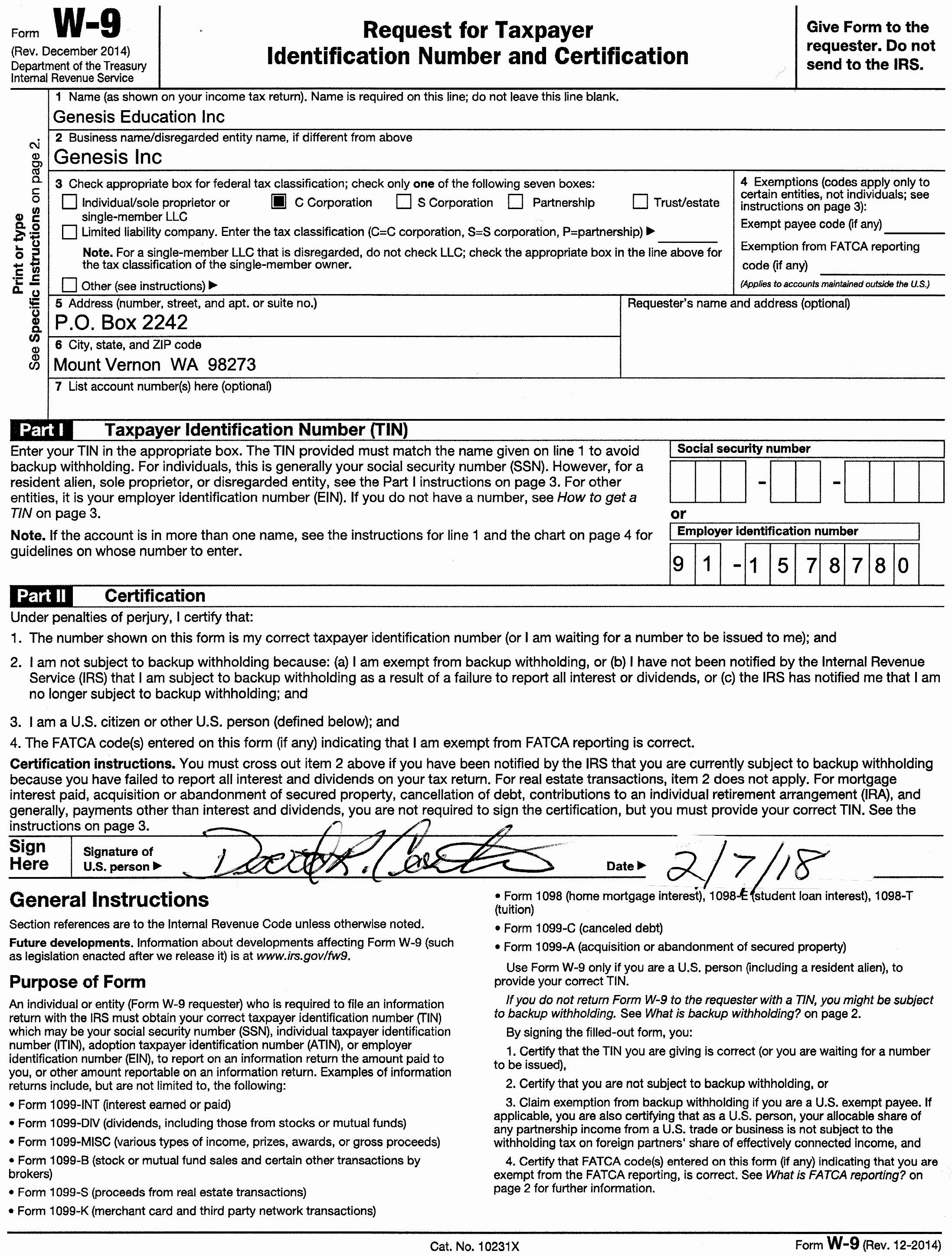

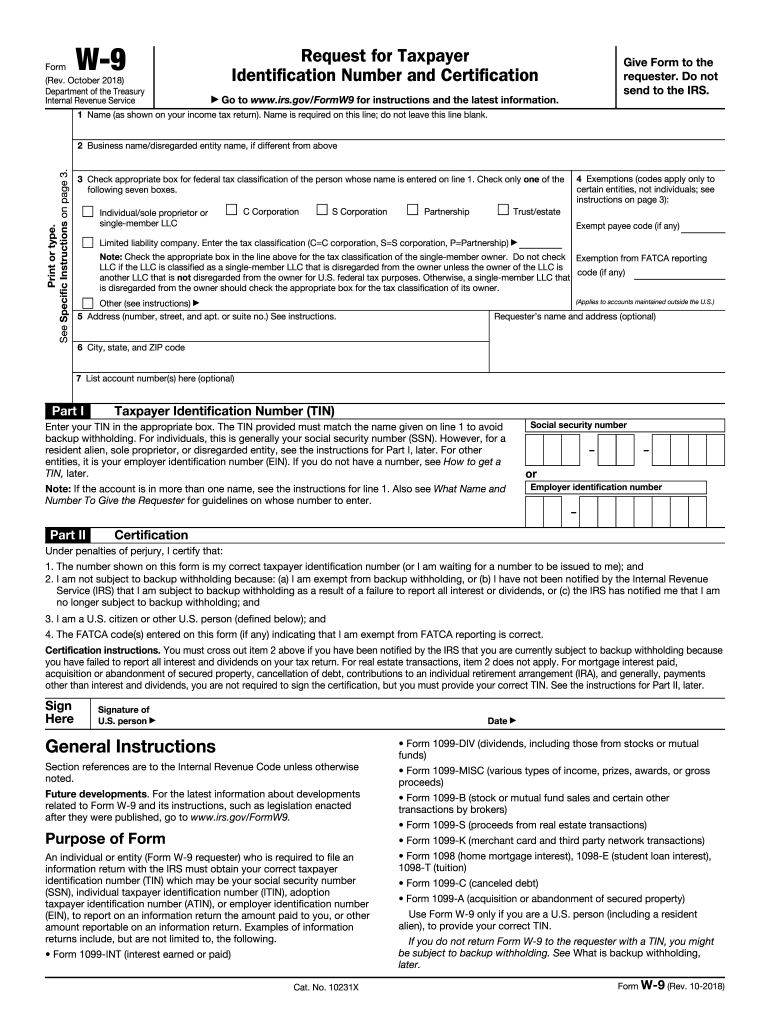

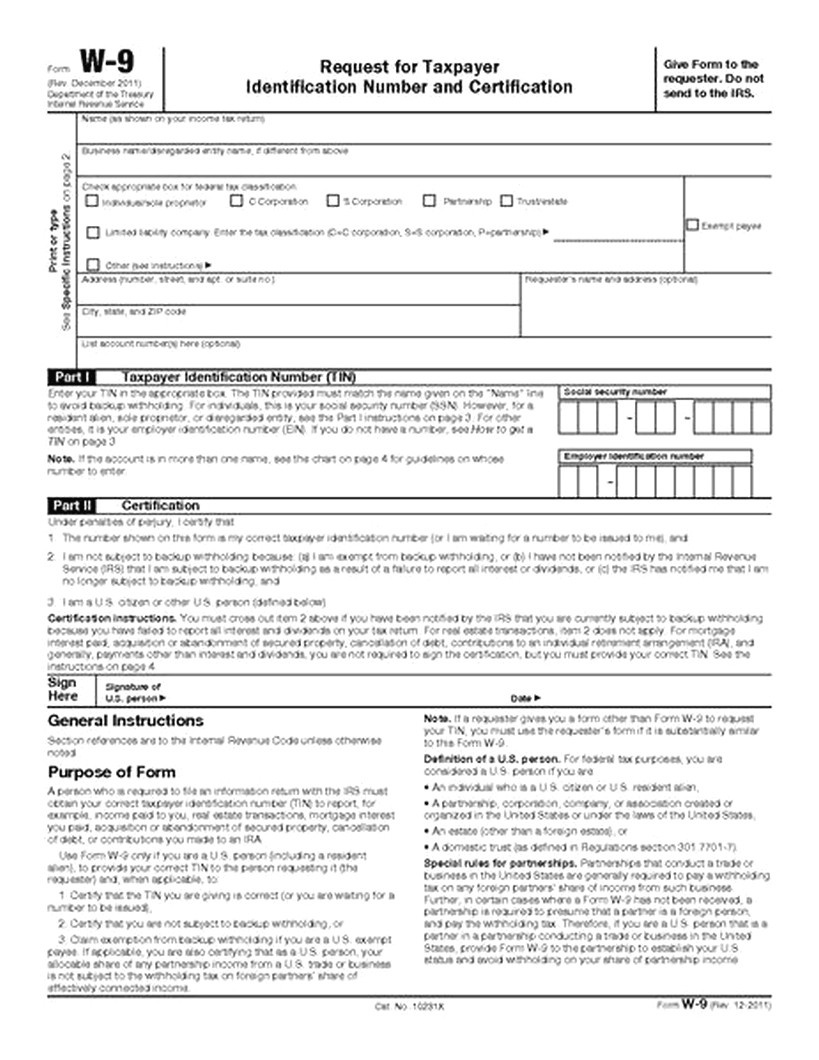

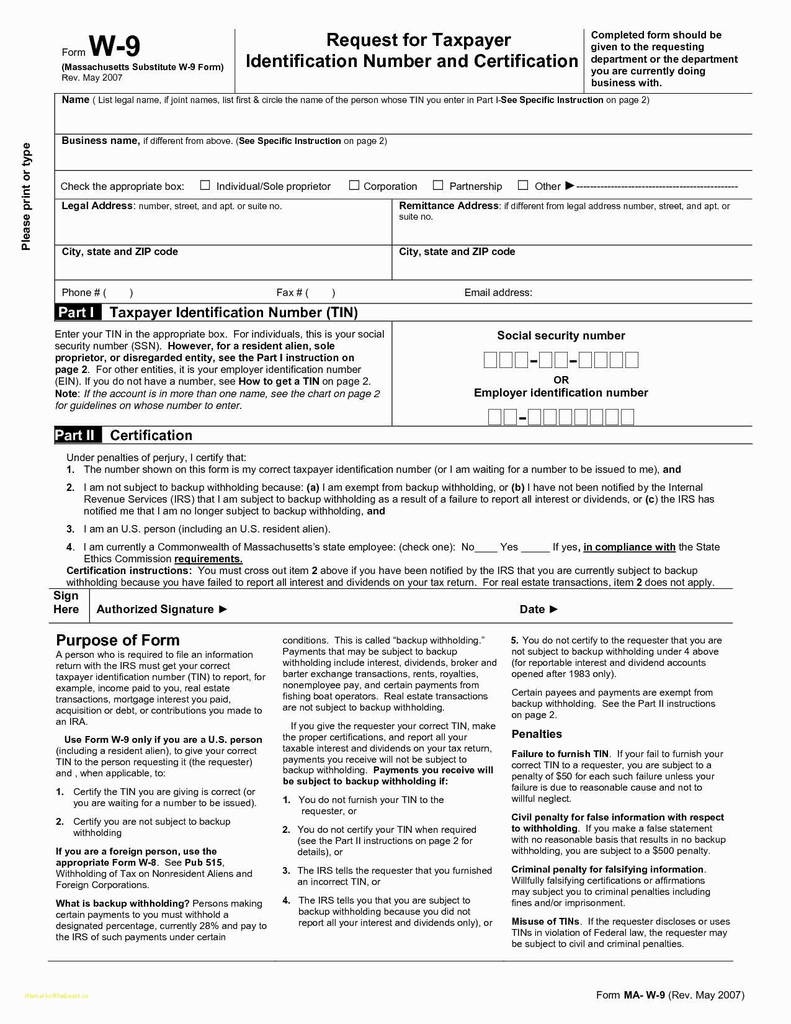

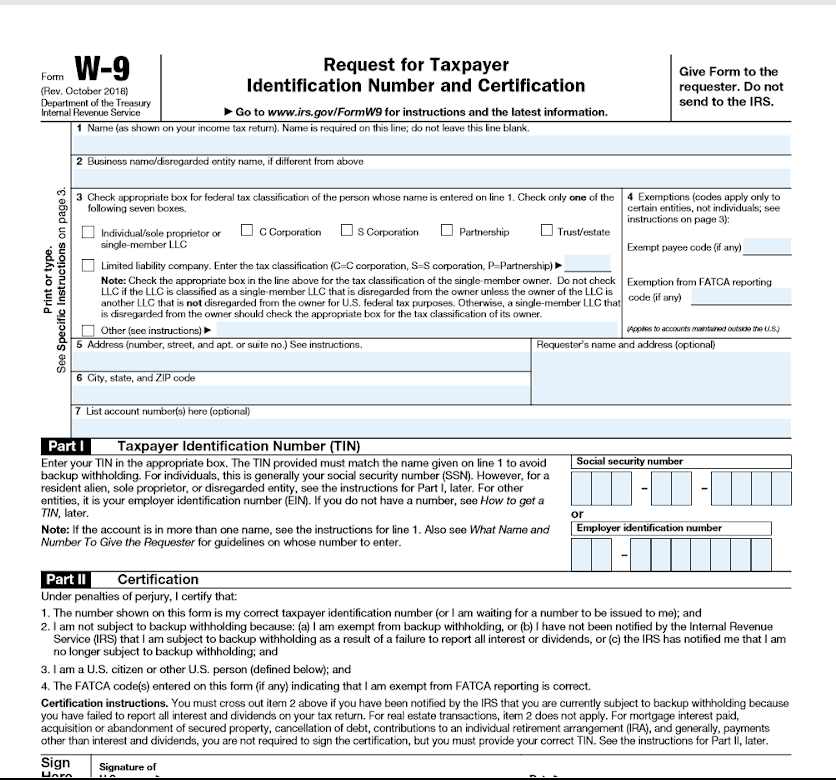

2017 W 9 Printable Form - Do not send to the irs. Name is required on this line; The taxpayer (you, the payee) isn’t subject to backup withholding. Once completed you can sign your fillable form or send for signing. Use fill to complete blank online town of brookhaven (ny) pdf forms for free. Once completed you can sign your fillable form or send for signing. Use fill to complete blank online indian hills community college pdf forms for free. All forms are printable and downloadable. Name (as shown on your income tax return). The name and the employer identification number of hirer should be indicated in the document. The tin you gave is correct. Give form to the requester. Do not send to the irs. Or by state employees who are seeking reimbursement. Request for taxpayer identification number and certification. The ein or ssn provided must match the name given All forms are printable and downloadable. November 2017) department of the treasury internal revenue service. Certify that the tin you are giving is correct (or you are waiting for a number. Just fill out the rest of the template by inserting the following information into the empty fields. All forms are printable and downloadable. Your name as shown in your income tax return; Enter your address on lines 5 and 6. A combination of a list b and a list c document. The tin you gave is correct. Remember to sign your final w 9, otherwise, it won`t be accepted. For instructions and the latest information. A combination of a list b and a list c document. The taxpayer (you, the payee) isn’t subject to backup withholding. Certify that the tin you are giving is correct (or you are waiting for a number. Just fill out the rest of the template by inserting the following information into the empty fields. Do not send to the irs. For instructions and the latest information. Your address (city, state and zip code); For instructions and the latest information. November 2017) department of the treasury internal revenue service. Remember to sign your final w 9, otherwise, it won`t be accepted. Do not send to the irs. Do not send to the irs. Or by state employees who are seeking reimbursement. Your name as shown in your income tax return; Name (as shown on your income tax return). Amount of taxes withheld from earnings; Employees may present any list a document. November 2017) department of the treasury internal revenue service. Your name as shown in your income tax return; Use fill to complete blank online town of brookhaven (ny) pdf forms for free. Enter your address on lines 5 and 6. Once completed you can sign your fillable form or send for signing. For instructions and the latest information. Use the address on your tax return if your business address is different from your home address. Request for taxpayer identification number and certification. This includes citizens and noncitizens. Your name as shown in your income tax return; Once completed you can sign your fillable form or send for signing. Certify that the tin you are giving is correct (or you are waiting for a number. All forms are printable and downloadable. Name (as shown on your income tax return). The name and the employer identification number of hirer should be indicated in the document. Your name as shown in your income tax return; Or by state employees who are seeking reimbursement. For instructions and the latest information. Name (as shown on your income tax return). Web to fill out a printable template in pdf according to the requirements we offer you to refer to the list of needed details below: November 2017) department of the treasury internal revenue service. Name is required on this line; Do not send to the irs. The name and the employer identification number of hirer should be indicated in the document. The taxpayer (you, the payee) isn’t subject to backup withholding. Enter your address on lines 5 and 6. Just fill out the rest of the template by inserting the following information into the empty fields. Request for taxpayer identification number and certification. Certify that the tin you are giving is correct (or you are waiting for a number. Once completed you can sign your fillable form or send for signing. Give form to the requester. Use fill to complete blank online town of brookhaven (ny) pdf forms for free. Amount of taxes withheld from earnings; This includes citizens and noncitizens. The ein or ssn provided must match the name given All forms are printable and downloadable. Your name as shown in your income tax return; This part of the form must be completed no later than the time November 2017) department of the treasury internal revenue service. A combination of a list b and a list c document. Certify that the tin you are giving is correct (or you are waiting for a number. Request for taxpayer identification number and certification. November 2017) department of the treasury internal revenue service. Do not leave this line blank. By signing it you attest that: Do not send to the irs. Give form to the requester. Remember to sign your final w 9, otherwise, it won`t be accepted. Just fill out the rest of the template by inserting the following information into the empty fields. Name is required on this line; This includes citizens and noncitizens. Use the address on your tax return if your business address is different from your home address.How To Sign W9 Form Online Peggy King's Template

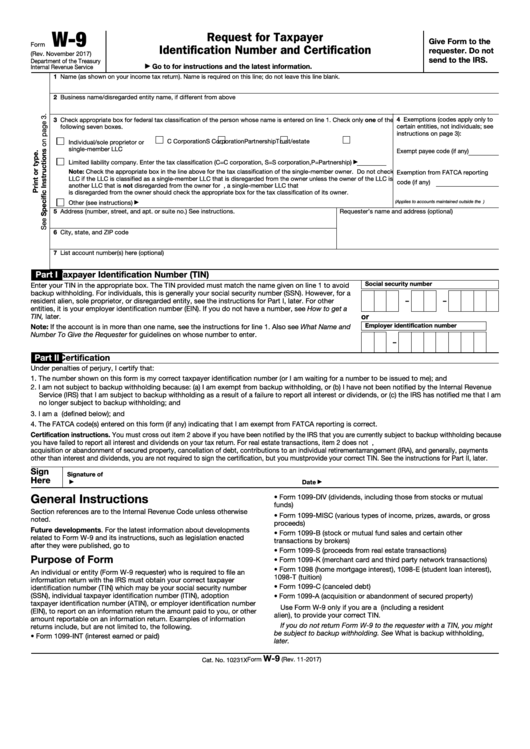

Fillable Form W9 Request For Taxpayer Identification Number And

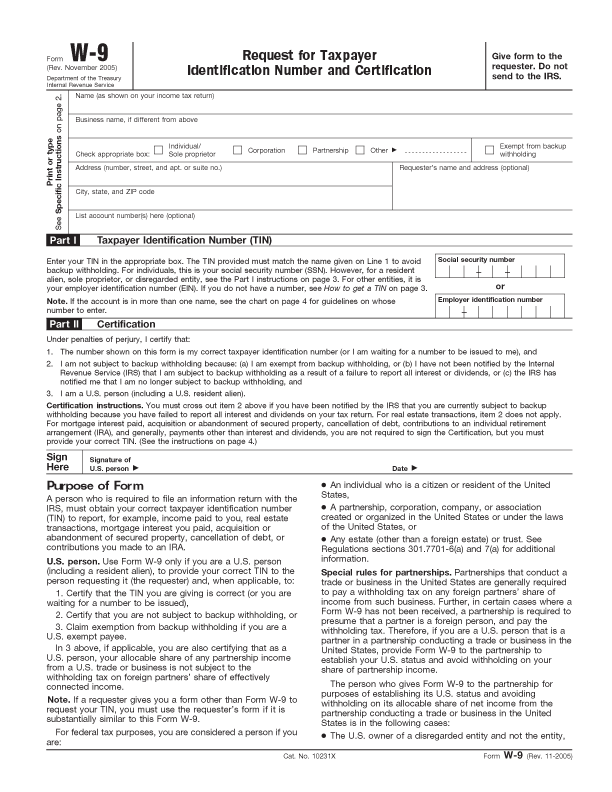

Irs Blank W 9 Form 2020 Printable Example Calendar Printable

W9 (20142016) Edit Forms Online PDFFormPro

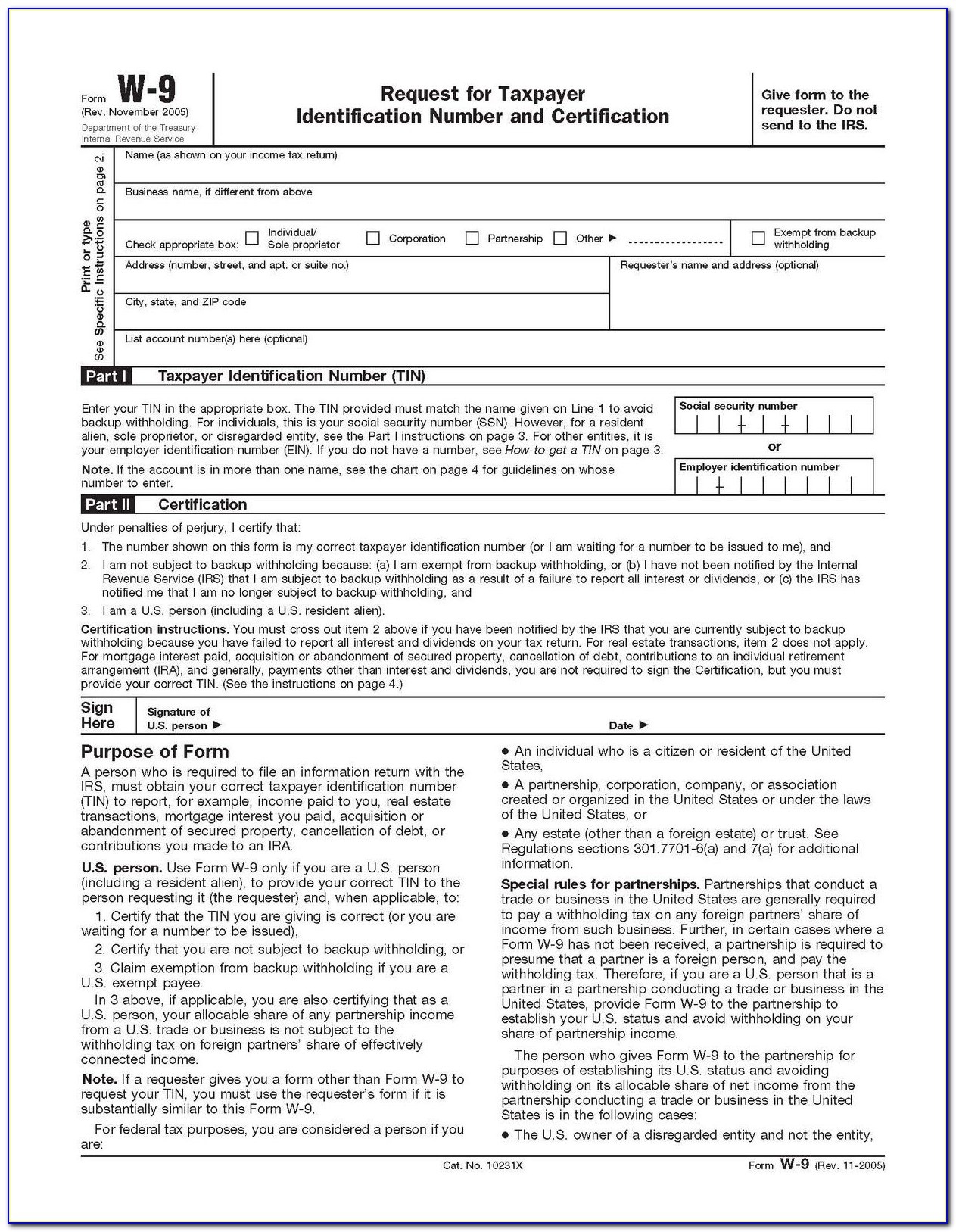

W9 Form Printable 2017 Free Free Printable

20182023 Form IRS W9 Fill Online, Printable, Fillable, Blank pdfFiller

W9 Form Printable 2017 Free Free Printable A to Z

W 9 Form 2017 Printable Inspirational Free Fillable 1099 Misc Form

Blank W 9 Printable Form Template Calendar Template Printable Monthly

W9 vs 1099 IRS Forms, Differences, and When to Use Them

The Tin You Gave Is Correct.

Use Fill To Complete Blank Online Indian Hills Community College Pdf Forms For Free.

Amount Of Taxes Withheld From Earnings;

Name (As Shown On Your Income Tax Return).

Related Post: